The rapid expansion of online video platforms in recent years has led to increased audience fragmentation, requiring media companies to scale and diversify their distribution models to capture the widest audience possible. Consumers are looking to access high-quality content while managing subscription costs, with more affordable, ad-supported viewing models like FAST and AVoD becoming increasingly popular choices. Today, content providers need flexible and highly efficient advertising workflows to support multiple business models while maximising monetisation across a growing range of distribution channels.

Advances in workflow automation and growing streaming viewership mean digital ad revenues are performing well and are providing more opportunities for content providers to tap into new revenue streams. In 2024, major media companies are rethinking their approach to complex ad insertion workflows to simplify multi-platform distribution while taking control over their digital ad revenues.

Harnessing ad signalling innovation to power linear channels

Traditional TV advertising is still a compelling prospect for advertisers, with billions allocated to ad spending every year for non-addressable campaigns targeting huge linear TV audiences. However, as overall linear consumption declines in favour of online video subscriptions, we’re seeing an increased focus on digital advertising as ad sales teams push to convert traditional inventory into more valuable, targeted ad campaigns. For organisations looking to deliver content via traditional broadcast, cable, or OTT distribution, the likelihood is that you’ll be trying to find ways to increase the value of your ad inventory while supporting more personalized viewing experiences.

In an increasingly fragmented distribution landscape, all media companies need effective ad break signalling and metadata insertion capabilities to facilitate seamless downstream ad insertion and personalisation. Content providers need frame-accurate signalling capabilities to ensure viewers enjoy high-quality advertising experiences. Meanwhile, the ability to provide custom ad profiles for any distribution platform helps increase ad value and support effective regionalisation. Media companies can also easily monetise previously undecorated channels through advanced content versioning and ad enablement tools, expanding their distribution across new markets while unlocking new revenues.

However, facilitating this level of channel customisation at scale and enabling efficient downstream ad insertion is incredibly demanding, and it requires highly interoperable, intelligent signalling technology. With the right tech stack, media companies can overcome today’s complexities by tying together disparate ad sales, playout automation systems, and ad decisioning platforms. Regardless of their size, content owners are looking for the connective tissue to bring together a fragmented ecosystem and enable the bi-directional data transfer that drives personalisation and targeted ad experiences.

Unleashing the potential of linear addressable advertising

Just a few years ago, linear addressable TV advertising was considered too raw and unproven a technology for risk-averse brands and content owners to bet on. Today, linear addressable technology is maturing rapidly, and media companies and ad buyers are gaining more understanding and confidence around its potential.

Universal ad signalling technology makes linear addressable advertising simple, helping media companies deliver targeted advertising across live, linear programming. Through intelligent watermarking, SCTE triggering, and other metadata formatting and insertion, fully managed services can support frame-accurate ad insertion for addressable inventory — enabling brands to target households with curated, highly personalised ad experiences while enhancing value for broadcasters and supporting complex, competitive separation agreements.=

Securing greater control over your ad revenues

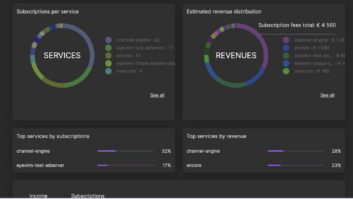

A surge in global video streaming and ad tech innovation has created a highly competitive vendor environment. Many technology providers have been quick to pioneer advanced ad insertion systems that enable broadcasters to pursue digital distribution strategies across multiple platforms. While agile partnerships based around pay-as-you-scale charging models with additional fees per ad break or impression can help get your digital channels up and running, many content providers are beginning to find themselves victims of their own success. As digital viewership and total ad spend increase, media companies’ high-performing channels can face significant taxes from their technology providers when revenue models involve incremental costs or sharing a portion of your CPM-based revenue with your ad insertion provider.

This model has led to many media companies now looking for ways to take greater control over their digital ad revenues. For some, that might mean questioning whether to invest heavily in developing new technology in-house — or potentially even acquiring a technology company to extend their existing tech stack. Most of them will find that re-assessing their vendor strategy is a quicker, easier, and more cost-effective strategy.

In a marketplace where experimentation is critical, broadcasters want assurances of cost-predictability, flat fees and fixed costs of origination and distribution of content. Ultimately, they need more transparency from their technology partners to know they can cost-efficiently and reliably launch new services while exploring new business models and advertising capabilities. Media companies have tried and tested advanced advertising workflows at scale and now have a much deeper pool of data and actionable insights to inform their advertising strategies. Importantly, they now know they can make more money from addressable campaigns. Business leaders are now looking for ways to capitalize on digital ad success while securing long-term profitability through more transparent vendor pricing models.

Media leaders understand the need for proven experience and intelligent, IP-based technology to simplify disparate video transmission and ad insertion workflows. At the same time, folks aren’t looking for technology partners that might take advantage of their hard-earned success. As technology and service providers, our role must remain as the enabler. With future-ready, IP-based foundations and smart ad signalling strategies, media businesses of all flavours have a lot to play for in 2024.