Premium video advertising is advancing at an impressive rate in Europe thanks to the migration of IP delivered content to the big screen and the increased popularity of live streaming, according to a new report from FreeWheel.

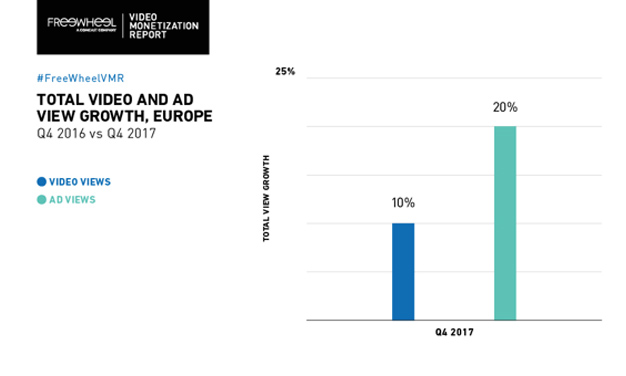

The Q4 2017 Video Monetisation Report (VMR), which looks at the performance of premium video for the whole of 2017, as well as including figures for the last quarter, found that ad views in Europe were up by 20 per cent across the year. This compares with a 22 per cent growth in the US during 2017.

Over the last quarter, data from the VMR highlighted three major trends for Europe:

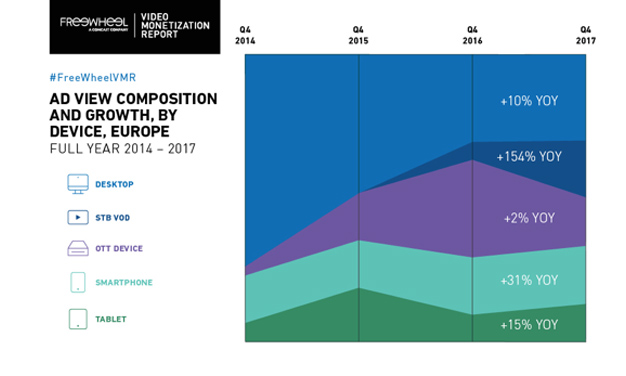

- The big screen continues to grow in importance for premium video thanks to the explosion of Set-Top Box Video on Demand (STB VoD) and Over-the-Top (OTT) delivery, which have a combined 37 per cent share of ad views in Europe. STB VoD saw 154 per cent year on year growth in ad views.

- Boasting double-digit growth – 45 per cent and 30 per cent for video and ad views respectively – live content can be seen as a new contributor to premium video’s continued success in Europe. In both the European and US markets, publishers are using tent-pole events to push the growth of live viewing.

- There has been continued collaboration within the industry, with the strengthening of operator syndication agreements and the forming of alliances, such as the European Broadcaster Exchange (EBX). Premium broadcasters are joining forces, and also forging partnerships with operators to maximise inventory.

Additional findings included:

- Ad views from clips saw impressive growth in the European region in Q4, increasing 119 per cent YOY and representing 21 per cent of the market

- The advance of programmatic video has continued in Europe, up 24 per cent YOY and now holding around 20 per cent of ad view share. Similarly, the US market has also seen a positive growth of 29 per cent YOY; although this still only accounts for 10 per cent of ad views

- 2017 saw a decrease in ad loads within premium video content to maintain the positive balance between monetisation and viewer experience. On average, viewers in Europe experienced 4.63 ads per long-form break in Q4, compared to 5.95 ads per break in Q4 2016; equating to a reduction of 42 seconds

The report concludes that the continued growth of premium video was a result of continued technological innovation in the industry, plus the fact that advertisers and agencies were demanding more premium video inventory, leading to greater creative diversity and falling ad repetition rates.

The full report can be downloaded here.