Ampere Analysis has released findings of it latest report into video content on YouTube and Facebook, concluding that there will be both winners and losers in this new advertising ‘arms race’. Facebook hasn’t yet been able to compete with YouTube’s ability to deliver revenue returns to content creators through its global audience, however, Ampere believes Facebook is making a serious play for content owners.

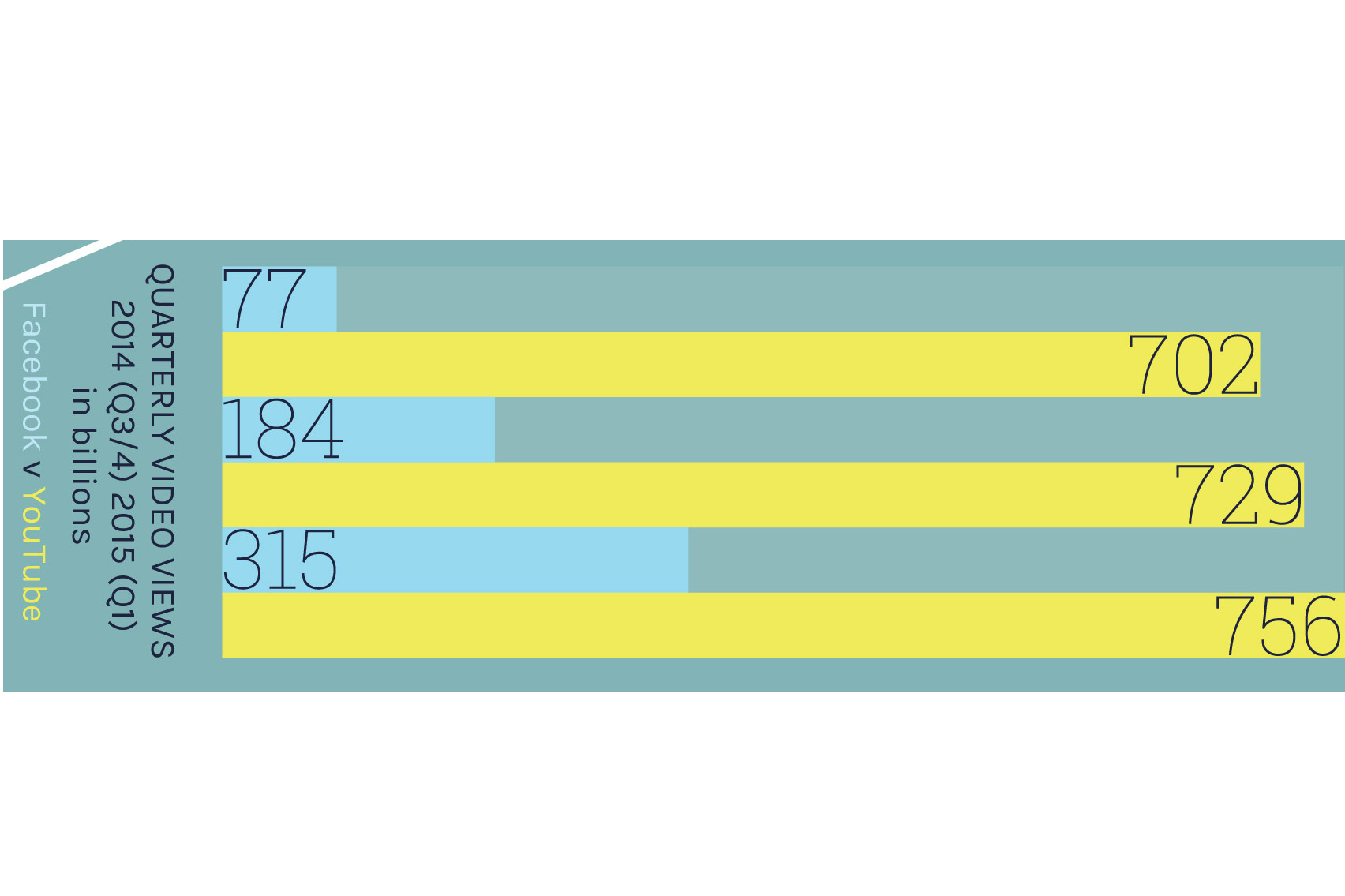

Facebook is catching up with YouTube’s video views, and Ampere Analysis expects it to exceed two trillion videos this year: two thirds of YouTube’s projected total for the same period.

To date, most content providers have used Facebook for branding and awareness purposes, but trial revenue-sharing collaborations with NFL and Fox Sports would elevate it to a serious challenger to YouTube’s dominance, stated Ampere. A partnership model with content providers would mean that they could monetise users of the social network and would encourage content creators to upload their own videos.

Ampere Analysis expects Facebook to trigger an advertising ‘arms race’ by competing directly against YouTube for user-uploaded video audiences. Although the social network has so far resisted, Ampere Analysis believes that Facebook will move to some pre-roll ads on its video assets to improve remuneration for key content partners.

Almost 15 per cent of internet users across western Europe and the USA have watched videos on Facebook in the last month, according to Ampere Analysis’ estimates. A sixth of Facebook video viewers have not watched YouTube in the last month, according to a survey of over 10,000 European and North American consumers.

By Ampere Analysis’ estimates, Facebook and YouTube are neck-and-neck in terms of monthly active users (MAUs) globally. The main constraint to monthly user growth is broadband take-up, rather than awareness. One significant advantage for Facebook is that its video views are served to logged-in users, giving it far greater volumes of highly valuable, personalised user data than most other online video services, including YouTube.

However, Facebook’s policy of using post-roll video ads is a disadvantage. Many online video service providers have abandoned this format in favour of queuing up new content, around which they serve fresh pre- and mid-rolls. Content owners will be reluctant to expand existing services from YouTube to Facebook without reassurance that returns per view are comparable in scale – no-one will want to risk cannibalising existing revenue streams if current users shift viewing platform.

In terms of ad rates, YouTube charges advertisers only when an advertisement has been adequately consumed, whereas Facebook offers the less advertiser-friendly model of charging once three seconds of the video have been delivered. Ampere Analysis has discovered that, despite the differences in approach, costs are closely aligned, suggesting that Facebook’s inventory is more valued by advertisers.

Richard Broughton, research director, said: “As Facebook moves from testing its advertising models to more actively soliciting content creators to join the platform, it will come under increased pressure to match the opportunities and per view returns generated by other platforms – notably YouTube. Ultimately, despite Facebook’s current reticence around offering pre-rolls, it may have to bite the bullet and add them to its repertoire. If the social network’s own video ambitions are to be realised, and if it is to convince content owners it is a viable alternative to YouTube, it must deliver comparable returns.”

YouTube is already beginning to respond to the impending competition, shoring up its defences. Key content creators have been encouraged to sign exclusive deals to reduce the risk of poaching.

YouTube released interactive within-video-ad shopping functionality in May, via which advertisers can showcase product details and provide click-to-purchase options to viewers. Test campaigns revealed improved brand recall and significant increases in revenue per impression.

Broughton concluded: “The scale of the two players is such that there is likely to be no speedy victory for one side or the other – years of competition are on the horizon. From a consumer perspective, exposure to increased volumes of advertising is almost a certainty, but improved returns for their favourite channels will mean more content to watch. Any losers are most likely to be smaller video services or broadcasters caught in the crossfire, unable to keep up. For such companies, the old adage ‘if you can’t beat them, join them’ may well prove to be the wisest course of action.”