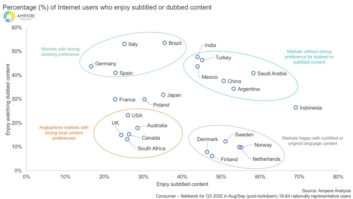

Research from Ampere Analysis suggests that consumers in English speaking markets are the least likely to watch foreign language content, with the UK and South Africa recording the lowest preferences for subtitled and dubbed content.

Ampere says that that across all territories, it’s research has found that younger viewers are more engaged with overseas content than older consumers, with 18-24-year-olds largely prefer watching subtitled content while older demographic groups are proportionally more in favour of dubbing than their younger peers. More broadly, the analyst’s findings show that only 24 per cent of internet users in the UK said they enjoyed watching subtitled content, and 15 per cent said they enjoyed dubbed content.

In terms of streaming services, the research states that in Netflix’s English-speaking markets, 100 per cent of its catalogue is subtitled while that number drops to 80 per cent in markets where consumers favour subtitling over dubbing such as Sweden and Netherlands. At the other end of the scale, Turkey has only five per cent of its Netflix catalogue available in local subtitles. In markets where dubbed content is preferred, only about 60 per cent of Netflix’s catalogue is available with audio in the local language.

Amazon Prime Video on the other hand offers more local content in some of its major retail markets, and also provides higher rates of dubbing – with 70 to 80 per cent of its catalogue dubbed in some countries, such as France, Italy and Spain. However, in markets where subtitles are preferred such as Mexico and Netherlands, just 40 to 50 per cent of the catalogue has subtitled content.

Amazon Prime Video on the other hand offers more local content in some of its major retail markets, and also provides higher rates of dubbing – with 70 to 80 per cent of its catalogue dubbed in some countries, such as France, Italy and Spain. However, in markets where subtitles are preferred such as Mexico and Netherlands, just 40 to 50 per cent of the catalogue has subtitled content.

“Netflix and Amazon Prime video take distinctly different approaches to content localisation. Amazon Prime Video offers higher rates of local content and dubbing in its key retail markets, including India, Germany and Japan,” explained Lottie Towler, senior analyst at Ampere Analysis.

“Meanwhile, Netflix relies on subtitling for localisation in the markets we analysed. In several cases, the most under-served markets for localisation are some of the biggest in terms of revenue; notably France, Spain and Germany, each of which showed preferences for dubbed content over subtitled. Targeting these key markets with more dubbed content would make international catalogues more accessible to consumers.”