With sites offering pirated digital content recording 53 billion hits per year, operators must monetise existing and new revenue streams by offering new exciting content incentives. But, how should they do this, asks Doug Lowther, EVP Digital TV, Irdeto (pictured below).

There’s no doubt that consumer viewing habits are changing at a rapid pace. This is due, in part, to the seemingly endless options for consumers to watch what they want, where, when and on any device of their choice.

The challenge for the operator to implement a business model that creates a consistent multi-screen user experience that keeps subscribers engaged and loyal is great. This experience must not only be flexible but also interactive, personal, portable and social. In today’s competitive industry, operators must deliver on all these consumer demands or they will turn to other providers.

According to a recent Media 3.0 market survey, commissioned by Irdeto and undertaken by Communispace, in order to satisfy these identified consumer needs operators must disrupt the traditional business model, offer innovative and interactive content to monetise offerings, and educate consumers about new innovative industry solutions and products.

The Media 3.0 survey demonstrates a range of 124 consumers’ viewing habits and preferences. The survey found four key areas vital to continued success for operators:

1. Disrupt – changing the business model

Nearly half of the survey participants (42%) believe that pay TV operators will adapt subscription models to mirror that of popular mobile handset models by giving away free connected devices with subscriptions. In a rapidly changing and highly competitive TV everywhere environment, pay TV providers must disrupt the traditional business model by offering a multi-screen strategy that delivers and synchronises content to any screen thereby breaking the content silo boundaries of VoD, PVR and live TV. This will ensure that they are able to meet consumer demand for a subscription that can be tailored to a device of choice.

2. Innovate to monetise

The survey found that YouTube received the most votes (90%) for the most used online tool to view video content and that while 44% of respondents are willing to pay for media content, an astonishing 42% of those surveyed in the Media 3.0 survey responded that they never pay for media content.

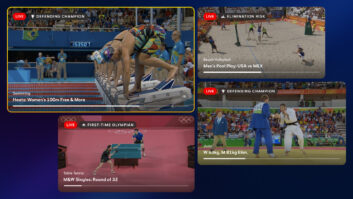

Operators must look to offer innovative services on these mobile platforms to compete with popular video services such as YouTube and monetise their content. For example, by offering consumers the next generation of Social TV functionality across multiple screens operators can secure customer loyalty, reduce churn and maximise revenue streams.

Operators can allow Social TV capabilities by implementing an innovative, end to end, secure broadband solution that empowers them to provide a realtime, personalised content discovery experience and true engagement and interaction with content. This means that consumers can play along with their favourite TV programmes and live sports games, compete against friends to share the experience, assemble communities around their favourite content and participate in realtime interactive polling, gaming and voting.

According to the Social Media Summit this year, 35% of US iPad or tablet use takes place in front of the TV. Operators should capitalise on this growing trend of using companion devices to enhance the viewing experience by offering consumers access to intuitive social applications on these devices. Brand loyalty, especially to pay TV providers, is often weak among consumers. Offering services on a companion device will work to help ‘lock in’ the consumer who is more likely to stay with the operator if they have the ability to tap into social networks on laptops and on mobile phones, comment on blogs and forums, and chat with friends in real time.

3. Innovation and education must go hand in hand

The UltraViolet initiative, backed by major Hollywood studios, will allow consumers to purchase digital copies of movies that can be stored online and transferred between devices without any additional cost. The licensing of content for this initiative has already started in the US and will start in the UK later this year, in preparation for the official consumer launch.

However, the majority of participants in the Media 3.0 survey (86%) were unfamiliar with the initiative, despite the fact that most (69%) would prefer to own videos they purchase to view time and time again on multiple devices. The broadcast industry must start to educate consumers about new innovations and initiatives such as UltraViolet now.

As stakeholders in the delivery and consumption of content in the home, operators should ensure they are able to take advantage of the opportunities the UltraViolet initiative will offer them, by implementing a DRM-agnostic security solution that is able to deliver and protect content to multiple screens.

4. Keeping the ‘edge’

With traditional broadcast entertainment models being challenged by a choice-driven consumer, a compelling multi-screen experience has evolved from a business option to a necessity. A varied and flexible offering and subscription to access content across any device, social functionality and interaction built into content offerings coupled with a healthy dose of consumer education into new industry propositions will ultimately help secure customer loyalty.

Results of the recent Media 3.0 market survey

commissioned by Irdeto and undertaken by Communispace

• 2% of respondents have never watched TV online

• Over 50% of respondents consume video and subscribe to movies and sports online

• 89% view content via PCs/Laptops, while only 6% watch their video content via apps

• Pay TV providers must continuously adapt their business model to quickly deliver new and innovative services across devices

• Pay TV providers should adapt their subscription models by giving away free connected devices with subscriptions

• Nearly half of participants (42%) believe that Pay TV operators will adapt subscription models to mirror that of popular mobile handset models by giving away free connected devices with subscriptions

• The survey found that 60% of the community watch all or some of their video content via apps

• YouTube unsurprisingly received the most votes (90%) as the most used online tool to view video content

• The majority of participants in the Media 3.0 survey (86%) were unfamiliar with the UltraViolet initiative, despite the fact that most (69%) would prefer to own videos they purchase to view time and time again on multiple devices

• 44% of respondents are willing to pay for media content

• 42% of those surveyed in the Media 3.0 survey responded that they never pay for media content (ie. music, video, film)

With sites offering pirated digital content recording 53 billion hits per year, operators must monetise existing and new revenue streams by offering new exciting content incentives. But, how should they do this, asks Doug Lowther, EVP Digital TV, Irdeto (pictured below).

There’s no doubt that consumer viewing habits are changing at a rapid pace. This is due, in part, to the seemingly endless options for consumers to watch what they want, where, when and on any device of their choice.

The challenge for the operator to implement a business model that creates a consistent multi-screen user experience that keeps subscribers engaged and loyal is great. This experience must not only be flexible but also interactive, personal, portable and social. In today’s competitive industry, operators must deliver on all these consumer demands or they will turn to other providers.

According to a recent Media 3.0 market survey, commissioned by Irdeto and undertaken by Communispace, in order to satisfy these identified consumer needs operators must disrupt the traditional business model, offer innovative and interactive content to monetise offerings, and educate consumers about new innovative industry solutions and products.

The Media 3.0 survey demonstrates a range of 124 consumers’ viewing habits and preferences. The survey found four key areas vital to continued success for operators:

1. Disrupt – changing the business model

Nearly half of the survey participants (42%) believe that pay TV operators will adapt subscription models to mirror that of popular mobile handset models by giving away free connected devices with subscriptions. In a rapidly changing and highly competitive TV everywhere environment, pay TV providers must disrupt the traditional business model by offering a multi-screen strategy that delivers and synchronises content to any screen thereby breaking the content silo boundaries of VoD, PVR and live TV. This will ensure that they are able to meet consumer demand for a subscription that can be tailored to a device of choice.

2. Innovate to monetise

The survey found that YouTube received the most votes (90%) for the most used online tool to view video content and that while 44% of respondents are willing to pay for media content, an astonishing 42% of those surveyed in the Media 3.0 survey responded that they never pay for media content.

Operators must look to offer innovative services on these mobile platforms to compete with popular video services such as YouTube and monetise their content. For example, by offering consumers the next generation of Social TV functionality across multiple screens operators can secure customer loyalty, reduce churn and maximise revenue streams.

Operators can allow Social TV capabilities by implementing an innovative, end to end, secure broadband solution that empowers them to provide a realtime, personalised content discovery experience and true engagement and interaction with content. This means that consumers can play along with their favourite TV programmes and live sports games, compete against friends to share the experience, assemble communities around their favourite content and participate in realtime interactive polling, gaming and voting.

According to the Social Media Summit this year, 35% of US iPad or tablet use takes place in front of the TV. Operators should capitalise on this growing trend of using companion devices to enhance the viewing experience by offering consumers access to intuitive social applications on these devices. Brand loyalty, especially to pay TV providers, is often weak among consumers. Offering services on a companion device will work to help ‘lock in’ the consumer who is more likely to stay with the operator if they have the ability to tap into social networks on laptops and on mobile phones, comment on blogs and forums, and chat with friends in real time.

3. Innovation and education must go hand in hand

The UltraViolet initiative, backed by major Hollywood studios, will allow consumers to purchase digital copies of movies that can be stored online and transferred between devices without any additional cost. The licensing of content for this initiative has already started in the US and will start in the UK later this year, in preparation for the official consumer launch.

However, the majority of participants in the Media 3.0 survey (86%) were unfamiliar with the initiative, despite the fact that most (69%) would prefer to own videos they purchase to view time and time again on multiple devices. The broadcast industry must start to educate consumers about new innovations and initiatives such as UltraViolet now.

As stakeholders in the delivery and consumption of content in the home, operators should ensure they are able to take advantage of the opportunities the UltraViolet initiative will offer them, by implementing a DRM-agnostic security solution that is able to deliver and protect content to multiple screens.

4. Keeping the ‘edge’

With traditional broadcast entertainment models being challenged by a choice-driven consumer, a compelling multi-screen experience has evolved from a business option to a necessity. A varied and flexible offering and subscription to access content across any device, social functionality and interaction built into content offerings coupled with a healthy dose of consumer education into new industry propositions will ultimately help secure customer loyalty.

Results of the recent Media 3.0 market survey

commissioned by Irdeto and undertaken by Communispace

• 2% of respondents have never watched TV online

• Over 50% of respondents consume video and subscribe to movies and sports online

• 89% view content via PCs/Laptops, while only 6% watch their video content via apps

• Pay TV providers must continuously adapt their business model to quickly deliver new and innovative services across devices

• Pay TV providers should adapt their subscription models by giving away free connected devices with subscriptions

• Nearly half of participants (42%) believe that Pay TV operators will adapt subscription models to mirror that of popular mobile handset models by giving away free connected devices with subscriptions

• The survey found that 60% of the community watch all or some of their video content via apps

• YouTube unsurprisingly received the most votes (90%) as the most used online tool to view video content

• The majority of participants in the Media 3.0 survey (86%) were unfamiliar with the UltraViolet initiative, despite the fact that most (69%) would prefer to own videos they purchase to view time and time again on multiple devices

• 44% of respondents are willing to pay for media content

• 42% of those surveyed in the Media 3.0 survey responded that they never pay for media content (ie. music, video, film)