The way media is delivered to audiences is likely to see significant change in 2024.

From the ongoing adoption of AVoD by the major streamers, the ever-increasing popularity of FAST, and the arrival of Apple’s Vision Pro, viewers are likely to see some major changes in the way they consume media.

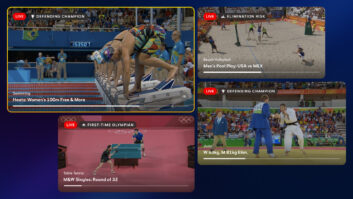

And, with both UEFA Euro 2024 and the Paris Olympics taking place this year, will 5G finally start to make inroads in terms of delivering the action to fans?

Harjinder Sandhu, director of marketing, Zixi

In 2024, we anticipate a significant uptick in the adoption of 5G network delivery, driven by its increasing availability in the public domain. The deployment and expansion of 5G infrastructure are set to revolutionise the media and entertainment industry in several ways:

- Enhanced Connectivity: 5G networks offer significantly higher data speeds and lower latency compared to their predecessors. This will enable smoother and more reliable streaming of high-quality content, making it ideal for live broadcasts, sports events, and other real-time applications.

- Mobile Content Consumption: The widespread availability of 5G will encourage more users to consume media on mobile devices. This shift is likely to prompt content providers to optimize their offerings for mobile, creating new opportunities for tailored and interactive content experiences.

- Remote and Cloud Production: Cloud production is expected to gain further ground in 2024. The improved bandwidth and reliability of 5G networks will be instrumental in facilitating remote production workflows. Broadcasters and production companies can remotely access and edit content from various locations, reducing the need for physical infrastructure and travel.

- Real-time Engagement: 5G’s low latency capabilities will enable real-time interactivity during live broadcasts. This opens exciting possibilities for engaging viewers with interactive elements, such as polls, live chats, and augmented reality overlays.

- Edge Computing: 5G networks will facilitate the deployment of edge computing solutions, bringing data processing closer to the source of data generation. This will be particularly beneficial for applications that require real-time processing, like AI-driven content enhancements and personalized recommendations.

The landscape for cloud production is evolving rapidly. New technologies are emerging to address the challenges associated with cloud-based production, such as security, data transfer and reliability. As these solutions mature, cloud production will become more accessible and cost-effective empowering content creators to collaborate seamlessly, access their media assets from anywhere, and streamline their production processes.

Michel Bais, chief product officer, Vislink

While it’s not a “new” trend, we believe that 2024 will be the year that 5G-centric applications will take the next great leap forward to full acceptance. This will be particularly evident in scenarios that can take advantage of hybrid public/private 5G solutions that can enable seamless event coverage and enhanced real-time content sharing. This will really help transform the way live events are produced and consumed.

Kjetil Horneland, CEO, Ease Live AS (an Evertz company)

Interactivity will move from early adopter status on its journey towards being a must-have. Anyone investing in OTT platforms at the moment is including mobile and connected TV interactivity in their requirements. Interactive content will likely become a separate rights category in future content negotiations.

We will see increased monetisation of the key moments of sports, through sponsorship and advertising; we will see teams increasingly innovate through interaction on all screens, with data, on-demand interactive features; and after a game we will see increased marketing activity around pushing highlights to fans and potential fans, particularly on mobile devices.

I would also add, that although younger generations are wedded to their mobiles, the TV is still critical to sports monetisation, as our experience of providing interactivity to connected TVs as well as mobiles and tablets, is that the average duration for of a viewer on TV is five times that of mobile devices.

Peter Vindevogel, CEO of The Park VR

We’ve seen the introduction of Apple into the industry in 2023 but the devices which they’re creating will enter the market in 2024, so we’ll be seeing companies and creative minds start to develop new possibilities because of this to keep up with the competition.

Photorealistic avatars are reaching a level of maturity and companies including Meta are working hard on developing tech within this area. The focus now is on delivering devices that can encapsulate this incredible computing power for broad audiences. The question is can we deliver apps or programmes that can turn a familiar device, such as a phone, into a creator of photorealistic avatar. This would be impressive as it would allow a familiar device to compete in the same realms as other software/hardware used in gaming and industrial applications.

There’s been a lot of discussion around mixed reality and mixed reality glasses in 2023. We’ll see a plethora of applications coming to the market using this mixed form of reality in 2024. Recent technology advancements mean that mixed reality is in a better shape to accelerate again and will be adopted across the masses due to its blend of the real and digital world. For example, you could wear these XR glasses to do simple tasks around the house in the real world and use them to enter a virtual world.

Gil Rudge, SVP, video products and solutions, Harmonic

Video service providers will continue to look for ways to simplify video streaming. I expect new innovations will be introduced to reduce operational costs by leveraging OTT-based technologies for some of the traditional workflows. In addition, AI will be leveraged for creating content playlists, improving automated channel scheduling, simplifying content preparation, boosting monetization, speeding up sports highlights creation, and more.

Sally Winship-Comollo, director of communications, Edgio

Consumer interest in AVoD and FAST is set for continued growth as audiences embrace more affordable viewing experiences with relevant, tailored advertising. Content providers are pursuing hybrid revenue strategies to align with these consumer shifts, and we’re seeing healthy momentum behind the ad-supported subscription tiers from major streaming players — Ampere Analysis research showed total ad-supported subscriptions reached 100M in the US in 2023. To enable this level of flexibility, I think we’ll see an accelerated shift toward the managed services approach as customers focus on managing costs, streamlining their operations and reducing time to market.

The live sports market has evolved quickly in such a short space of time, fueled by frenzied market competition and consumer shifts toward streaming. Live sports is more fragmented than ever before, with a growing number of media companies sharing rights to leading sports properties. As rights fees continue to rise, rights buyers and sports broadcasters can’t reduce the costs of premium sports content, but they can deploy a number of strategies to maximize ROI and profitability, including individualizing the monetization of each stream through advanced advertising capabilities. At the same time, sports streamers are focusing on how to provide more engaging, individualized viewing experiences. This means being able to meet consumers wherever they are — serving them content in different ways with multiple price points, varying subscription packages, and delivery across both third-party services or via direct-to-consumer models

Although sports organisations understand the opportunities to slice and dice content in more ways than before to maximise value, building and managing the technology to produce and deliver live sports at scale is incredibly demanding. Sports teams, leagues and federations that find the right technology partner are in a fantastic position to grow their D2C strategies in 2024. By harnessing existing best-in-breed streaming workflows and pre-integrated partnerships, sports organisations can launch new services quickly while enabling broadcast-quality viewing experiences and maximum monetisation.

Trevor Elbourne, chief executive officer, Atomos

With many of the barriers to cloud workflows crumbling, we are starting to see a world where high bandwidth is a given, and low-latency communication is available almost everywhere – even in remote locations where LEO satellites like Starlink make broadband connectivity almost universal.

5G is still yet to be implemented worldwide but connected autonomous cars and industrial cloud services, especially low-latency ones, will bolster the business cases for both 5G and (incredibly) 6G. Bonded and segmented, private 5G connections, together with cloud editing, will improve the quality and immediacy of news, sports and event productions.

Vijay Sajja, founder & CEO, Evergent

Media companies are more open and creative in finding new ways to combat churn, harnessing specialist technology to address both involuntary churn, (e.g. when a subscriber’s card payment is declined) and voluntary churn (e.g. choosing to cancel a service). The right toolkit can include everything from predictive AI-powered tools to proactively tackle churn, intelligent payment retry features to maximise revenues, step-down payment plans or pause and resume incentives, and creative, customer-centric monetisation strategies to keep sports fans engaged after the season ends. Achieving these small improvements at a global scale across thousands – or millions – of subscriber interactions leads to a huge difference in revenue generation.

In 2024, we’ll see a lot more streaming organisations realise the benefits of moving beyond legacy billing and subscriber management systems toward more agile, cloud-based platforms that are built to scale. There are a number of media companies out there looking for ways to unlock the next phase of growth for their businesses. Whether it’s achieving global expansion across a number of new markets and regions, or building out new product offerings to grow additional revenue streams, you need flexible subscription management and monetisation tools that can handle multiple languages, currencies, payment systems, and business models simultaneously.

Bill Admans, chairman of the advisory board, Ateliere Creative Technologies

The race to monetisation will take centre stage as 2024 becomes the turning point for how content is offered. Traditional business models are evolving as media companies weigh their destinies in the streaming world. There will be a significant restructuring of the industry as major media companies continue to deprioritise broadcasting and cable. Disney has already hinted at selling off its former cash-cow linear assets as the studio shifts to deeper investment in capturing the booming streaming audience. Others will likely merge to combine scales of economy and better compete.

2024 will be a significant turning point in how content is offered. Audiences are already feeling the pinch as the cost of individual streaming platforms creeps higher. Bundling will become the tool that helps to ease subscription churn because it’s an all-or-nothing scenario. Bundling smaller streaming platforms with majors like Netflix or Prime will help to stabilize the revenue stream.

Advertising is proving to be the ingredient that makes the economics attractive for everyone. Consumers are willing to sit through a few ads to enjoy programming at an affordable price. Sharing the advertising revenue makes it equitable for content owners, streaming platforms, and aggregators. Whether it’s lower-priced ad-supported tiers like those offered by Disney, Netflix, and Max or free-to-stream FAST platforms like Pluto and Tubi, there’s plenty of valuable audience to exploit.

Tim Sewell, CEO, Yospace

We’ll see streaming numbers continue to surge in 2024, especially for live in an Olympics year. And a greater proportion of those streams will be ad-funded. We’ll see more advertising across the board and, as advertising strategies continue to mature, we’ll see more programmatic.

It’s going to be a bumper Summer of sport, with EURO 2024 football followed shortly afterwards by the Paris 2024 Olympic and Paralympic Games. Events like these are hotbeds of innovation and I fully expect some fantastic viewer experiences – with more choice available to viewers, from the range of events that are broadcast to the quality level of the streams. Behind the scenes, I expect advanced advertising strategies to really come to the fore.

Rick Allen, chief executive officer, ViewLIft

I expect institutional investment in sports by Private Equity and sovereign wealth funds to accelerate in 2024, with the caveat that the impact of conflict in the Middle East is raising the importance of political and reputational concerns.

Another trend will be the sports media industry creating ways to better reach Gen Z, the under-24-year-old digital natives who live through their smartphones, tablets, laptops and other non-TV devices. The Gen Z audience wants to consume sports in the same way it interacts with other interests: via streaming on their smartphones or other mobile devices through short, sharp content – social media platforms such as TikTok, Snapchat, Instagram, YouTube and Twitch.

To create the type of content that will really engage Gen Zers, live sports content producers will leverage artificial intelligence (AI) and cloud-based tools to enable near-real-time highlight clipping and editing.

Finally, a growing trend will be new and more robust on-screen monetisation mechanisms, including gaming, merchandise, sponsorship, and fan engagement. These developments will also lead to more opportunities for gambling, with AI playing an important role in setting real-time odds and game projections, and with viewers able to place bets on outcomes and individual acts, such as which team or player will be the next scorer. Supporting these new monetisation opportunities will be far more personalisation. Critical to making increased monetisation work and building profitable streaming services will be efficient collection and analysis of user data: aside from cord-cutting, this is I believe what’s going to make or break D2C.

Mathieu Planche, CEO at Witbe

The expectation that streaming services should work no matter where you are or what device you’re using is here to stay. Ads will become another factor in evaluating whether or not services are meeting that expectation. As more streaming services implement ads, I think we will see frequent comparisons analysing and recommending which services perform the best.

In 2023, there were a few cases of streaming services consolidating: Max replacing HBO Max and Discovery+, for example, and the launch of combined service Paramount Plus with Showtime. I wouldn’t be surprised to see more streamers joining forces in 2024 to bring their content and technical know-how together under one subscription.