BARB (Broadcasters’ Audience Research Board) has released its second Viewing Report, which provides a review of the way people are watching television and how this is changing. It examines the dynamics behind the reported levels of TV viewing, the challenges of delivering effective audience measurement, and new analyses including the take-up of SVoD services.

Online video clips, usually running to around ten minutes, are perceived as challenging traditional long-form programmes of 30 minutes or longer, says Deloitte’s Paul Lee. The most successful programmes in the UK occasionally attract more than 10 million viewers, a number dwarfed by the most popular short-form online content: by March 2015 UK-based Swede PewDiePie had garnered almost eight billion views and 35 million subscribers on YouTube.

Television companies are responding to this, says Lee: Disney acquired Maker Studios; Freemantle and VICE Media launched short-form on-demand channel Munchies; and both Channel 4 and BBC3 have created online spaces for short-form content. However, the Report highlights Deloitte estimates that in an average month over 360 billion hours of long-form video will be watched. Short-form is therefore probably around 3 per cent of all video watched on all screens, with global revenues of about $5 billion, compared with long-form content, which will generate $400 billion worldwide from advertising and subscription revenues alone.

‘Short-form should not be considered as a direct competitor to “traditional” long-form content’, says Lee, ‘but rather as an additional screen-based medium, addressing needs that were previously unserved or which are competed for by other media.’ He concludes that short-form is ‘a parallel future, but not the future, of screen-based entertainment’.

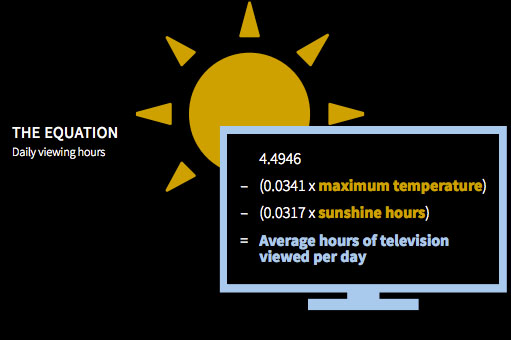

The Report details some interesting correlations between TV viewing and the weather. BARB, in partnership with RSMB, took four years’ worth of viewing data and analysed this against five weather variables. They concluded that overall, 70 per cent of year-on-year variability in audience levels can be attributed to the weather. There were regional differences and differences in behaviour of certain age groups: ‘Londoners and Georgdies are relatively impervious to the weather’ the Report claims, and ‘older demographics are far more subject to the dictates of the climate.’ BARB drew two conclusions from the figures: firstly, for every degree Celsius increase in maximum temperature, viewing falls by around 0.76 per cent; and secondly, for every weekly averages increase in daily sunshine hour, there is a reduction in viewing of around 0.71 per cent. A time period which sees better weather in the UK, then, may in part be responsible for some TV viewers tuning out, rather than the proliferation of new content platforms, which is often blamed for falling viewing figures.

The Report goes on to detail BARB’s Project Dovetail, a strategy to deliver cross-device viewing for all linear and on-demand content, by creating a hybrid system that will harness the strengths of panel data and device-based data. The aim of the project is to integrate this data into a single set of audience figures. The BARB panel consists of 5,100 households, which each represent about 5,000 other households across the UK.

“Dovetail is taking a lot of different techniques to answer a lot of the questions coming from advertisers, broadcasters and brands,” says BARB chairman Nigel Sharrocks. “There are a lot of questions about how much viewing is coming through on-demand viewing from online players.” Viewing has been tracked on the pane since 2012, and tablet data was added last August, though Sharrocks admits the Project has its challenges, ““I liken it to an American expression: how do we change all four wheels on the car while continuing to do 70 miles per hour in the outside lane?” he says.

The Report moves onto the growing popularity of new methods of content viewing, stating that total timeshifted viewing is up from 11.3 per cent in 2013 to 12.3 per cent last year. PVR ownership grew from just under 10 per cent penetration into UK households, to around 75 per cent in seven years, though is now beginning to plateau out at around three quarters of homes. As the Report asks: ‘Who needs a PVR when you can have (internet-delivered) video on-demand?’ Still, ‘we’re a long way away from seeing the emergence of an online TV content cloud’ and many viewers rely on a PVR to catch up on content they have missed, in their own time.

The BBC remains the most popular family of channels, attracting the highest combined audience share, according to BARB. This is followed by ITV’s channel group, Channel 4’s three offerings, with Sky and Channel 5 completing the top five broadcasters. Although UKTV, Viacom and Discovery all recorded modest gains, the top five channels on the EPG still account for 52 per cent of all viewing.

Entertainment programmes still top the genre league tables, with 18.4 per cent of audience share between 2008 and 2014, according to the Report. This is followed by drama, documentaries, and films. Sports comes in sixth place but, as the Report points out, ‘sport’s ratings performance depends largely on whether it has been a good year for Crown Jewel events: and as a consequence it tends to be the wild card in our genre analysis.’ The success of sports programming in a certain year may have a negative affect on other genres, however, the Report maintains ‘there’s every reason to believe we’re still in the midst of a Golden Age of television drama and entertainment.’

The biggest game-changers in the industry, the Report asserts, are SVoD platforms like Amazon Instant Video and Netflix. The ability to watch content from such providers on any screen, anywhere, has likely contributed to the fall in households with a broadband internet connection, but no traditional TV set: from 1,070,000 in 2013 to 1,103,000 in 2014. This is 4.3 per cent of all households. This increases when looking at certain age groups and locations: 12.4 per cent of households predominantly containing 16-24-year-olds in “metro” areas have broadband but no TV.

Trends in screen sizes are also explored in the report. The new curved TV screens are designed to offer viewers a more immersive experience, and this notion is driving the agenda for smaller screens too. Google Glass, Oculus Rift, Google Cardboard and Samsung Gear VR all offer promises of changing the way we view visual content. Not all new tech trends take on though: ‘it is with great sadness that we can confirm the continuing demise of 3D TV’ says the Report. The BBC phased out 3D production in 2013 and last year Sky revealed it would no onger offer Premier League matches in 3D, the ‘cornerstone of Sky’s marketing strategy’ for the technology.

BARB hopes it Viewing Report will be an annual fixture. More information can be found on the BARB website.