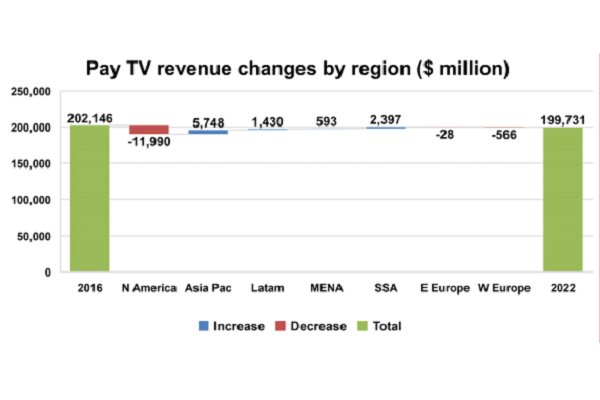

Global pay-TV revenues will peak at $202 billion in 2017, before plateauing at around $200 billion for the next five years, according to the latest Digital TV Research study.

The analyst’s ‘Global Pay-TV Revenue Forecasts’ report studied pay-TV trends in over 138 countries and found that revenues are set to decline in 33 countries between 2016 and 2022, even though they will likely more than double for 13 territories in this period. US revenues are forecast to plunge by a $12 billion over this time while Western Europe will likely see revenues slip by $566 million and Eastern Europe by only $28 million in this time.

The US is set to command 47.5 per cent of global pay-TV revenues – or $94.82 billion – by 2022, although this is way down from the 58.3 per cent recorded in 2010. In contrast, Digital TV Research expects Asia Pacific to record a $5.75 billion increase to $40 billion in 2022. Asia Pacific overtook Western Europe in 2013, and will be larger than the whole of Europe in 2017.

Revenues in Sub-Saharan Africa are projected to rocket by 57 per cent to $6.59 billion and by 17 per cent in Middle East & North Africa, up by $0.59 billion to $4.12 billion.

Looking at platforms, Digital TV Research forecasts that global analogue cable revenues will fall by $8.77 billion between 2016 and 2022 as most the remaining subscribers finally go digital. Digital cable TV are though forecast to fall by $3.14 billion, due mainly to subscribers converting from standalone status to bundles, which provide higher overall revenues for operators but lower TV ones. IPTV revenues will likely climb by $2.34 billion.

Satellite TV will add more than any other platform from 2016 to 2022, the $6.66 billion rise meaning that the total will be $89 billion. DTH and DBS satellite TV revenues are set to overtake total cable TV revenues in 2020, having passed digital cable a year earlier.