ITV’s second quarter results have been published today, and in light of this Ampere Analysis has taken a closer look at how the broadcaster has transformed itself from a single-market national commercial free-to-air broadcaster to a diversified global production and channel entity. ITV’s management acknowledges pay-TV and distribution are still key areas it must address, yet so far the 2015 investment cycle has failed to provide evidence that these are real priorities, says Ampere Analysis. The company asks: How will ITV get fit for the future of TV – where multi-device, multi-stream and direct-to-consumer delivery are fast eroding the single-screen mass-audience that still delivers for advertisers?

ITV has taken a multi-pronged reinvention strategy, says Ampere Analysis, with production at its core. Guy Bisson, research director at the firm, commented on the dilemma facing ITV’s management in 2007: “When your attempts to diversify into social media [ITV acquired social media site Friends Reunited] have been a disaster, your core TV advertising revenue is under increasing pressure, an economic downturn is fast approaching, and consumer entertainment viewing and consumption habits are changing at the fastest rate in history, what do you do?

“In the case of ITV, the answer was to turn to a familiar and safe bet: production investment. To date that strategy has been central to the broadcaster’s reinvention. What it does next to face for the future of TV will be essential to ITV’s continued reinvention.”

Since 2006, ITV has made 27 acquisitions or joint-venture investments, 20 in traditional production companies, three in digital production assets. Part of ITV’s overall strategy has been to internationalise its production base, and 40 per cent of acquisitions over the last ten years are US production entities.

According to Ampere Analysis there are three key areas management must address now and next – linear channel development, pay-TV and monetisation of online content.

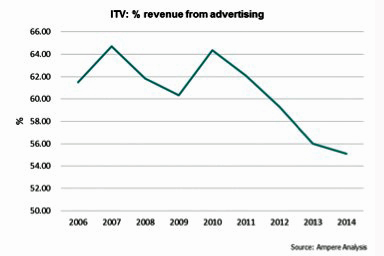

At 45 per cent, nearly half of ITV’s income is not advertising-reliant, up from 32 per cent in 2007. During the re-invention of ITV into a business that is no longer as dependent on advertising, it has perhaps neglected to fully shore-up its core linear business. Recently-launched drama channel ITV Encore is the only pay-exclusive channel brand in the portfolio of nine, although HD versions of ITV 2, ITV 3 and ITV 4 are pay-TV channels in the UK. ITV Premium, the ad-free version of catch-up service ITV Player has been a success for the broadcaster, although a pay-per-view option was shut down in 2014.

ITV’s single UK-based pay-TV channel contributes little to the revenue mix, and the broadcaster has been slow to exploit international pay-TV opportunities, says Ampere Analysis. Its now-global production base and strong presence in the US production market provide scope for a strong pay-TV linear channel presence outside the UK.

But as an alternative, OTT platforms offer the opportunity to go direct to a consumer who is increasingly demanding OTT programming. Its investment in Cirkus in Scandinavia looks set to be a test bed for a bigger play.

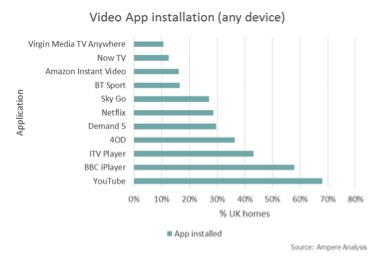

ITV’s online strategy is heavily reliant on ITV Player – the third most installed video application in the UK. Ampere Analysis’s consumer research shows that the broadcaster is missing key demographic groups, which could have long-term impact on online ad revenue.

Ampere Analysis’ forecasts suggest ITV’s share of UK TV advertising will remain relatively robust, but nevertheless will decline to a low of 39 per cent by 2020 as spend continues to move online. During the same time period, UK online advertising will grow to 56 per cent of UK media by 2020. ITV has its own interactive advertising platform, AdExplore, but unlike RTL and Proseiben has not invested in third-party ad-tech platforms.

Bisson concluded: “ITV’s overall strategy for reinvention has been largely successful, creating a business less dependent on advertising and more robust in an economic downturn. Along the way, however, it has sometimes neglected to focus on creating a fully-rounded broadcast group, positioned for the future distribution of the very TV content it now produces so much of. We believe that in addition to realising its YouTube strategy, ITV needs to look at next-gen distribution assets that will deliver strategy of internationalisation and pay-TV development and advertising technology. While production consolidation is likely to continue as a core strategy for the group, we believe ITV will increasingly seek opportunities in these areas.”