Conviva has released the findings of its report, Binge Watching: The New Currency of Video Economics, based on a recent survey of 750 consumers. The survey found that unavailable episodes, prompt nearly half of all OTT binge-watchers to give up on a series, with half of them neutral-to-unlikely to ever return. The survey also reveals the financial opportunities and implications of cultivating committed, engaged audiences.

“Binge-watchers represent dedicated consumers,” said Hui Zhang, CEO of Conviva. “As the line between OTT consumption and content creation blurs due to shifting viewing models, publishers need to ensure they’re building long-term value with viewers. Conviva helps the world’s top media and entertainment companies analyse, benchmark and optimise engagement through a 360-degree view of the entire video delivery ecosystem, ensuring an optimal binge-watching experience with every click of ‘Continue’.”

In the OTT market consumers are not subject to the contraints of an EPG and can watch shows when and where they want. Every view can be counted and each subscriber’s preferences and usage can be seen, with stakeholders in the industry benefitting significantly from this.

Conviva defines the binge-watching phenomenon in two ways: Firstly, as accessing an entire season, or multiple seasons, of a single show and watching them over a short period of time. Secondly, binge-watching can be defined as following a show closely enough that it is watched as soon as is convenient after it becomes available.

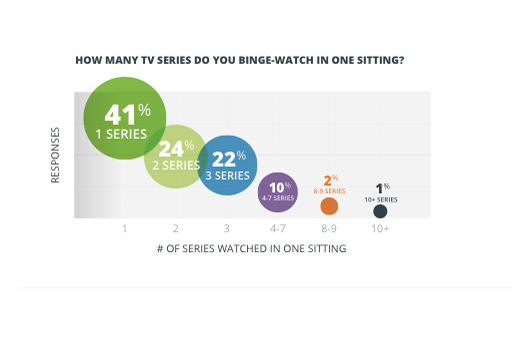

Conviva asked if respondents binge-watch shows: 87 per cent can only handle binge-watching three or fewer shows at the same time, and only one per cent claim to watch ten or more series at the same time. Twenty-four per cent admit to watching two series in a single sitting, and twenty-two per cent watch three series.

Users were also asked how they view a show when they binge-watch. The majority (61 per cent), stream content online, while only 11 per cent download to watch offline. The on-demand culture then, seems to be just that: that most viewers decide what they want to watch, and watch it there and then.

The idea that we will all soon be watching content on our smart phones is not true of binge-watchers, the report argues. Most viewers (60 per cent) choose to binge-watch on a computer, with the next most popular method of consumption being via regular pay-TV (37 per cent) followed closely by a connected device (36 per cent) and tablet (32 per cent). Less than a third would opt for a smart phone. For binge-watching this makes sense, as presumably viewers would not mind watching one or two episodes in lower quality, on a small screen, but to sit for a whole series or more requires a larger screen and better picture.

The report went on to ask binge-watchers, if an episode of a series you’re watching is unavailable, what do you do? Four in ten said they would go and seek another series if their desired episode isn’t available. This has implications for service providers, as the report states: ‘a customer who can’t find episode two of a twenty-six episode season is gone – for a total of 25 episodes. They also are one less audience member on the count of followers used to define the value of the content when it comes time for that show to be syndicated or otherwise re-licensed. And they are one less person likely to buy a DVD at the end of the show. Potential loss from that one individual alone could be as high as $100 (25 episodes at $3, plus a DVD at $25); that’s without counting the impact on re-licensing value, as each individual viewer is relatively meaningless.’

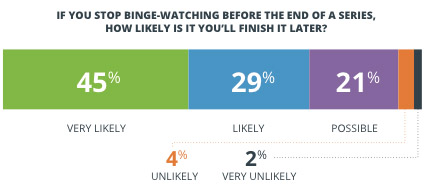

Conviva also asked survey respondents about the chances they’d come back to a show they had stopped watching, in principle ‘temporarily’. Forty-five per cent said they were very likely to return, however, 27 per cent were neutral to unlikely to return, which matches closely the 29 per cent who said they would move in in the case of an unavailable episode. Convia said of these results: ‘For content owners, the 45 per cent very likely to return should be a wake-up call: one ‘miss’ and over half of your committed audience is shaken from its dedicated stance. 55per cent more or less than fully committed to return, meaning not only is the 59 per cent of each individual viewer at risk but the re-licensing fees as well.

The report concluded: ‘The best way to build value in content, especially episodic TV content, is to build a committed, engaged audience, and nothing achieves that like building an audience of binge-watching viewers. With volume, quality, and – above all else – clear, credible and defensible measurements, the most valuable video properties will be those who crack the binge-watching code.’