The concept of the studio camera has come under extreme scrutiny and a substantial technical overhaul in the past few years and this has been accelerated by the drive to adopt 4K, 8K, cine uses and high speed applications for sports. As a result, the so-called studio camera may never be the same.

At one time it stood for a level of broadcast quality which set it apart from camcorders or field cameras and had little in common with the rise of digital cinematography cameras. That distinction is getting quite murky and it is the quality of the desired signal and not the setting – indoors versus outdoors, for example – that is the main determining factor today.

These changes are reflected by the new edition of Studio/Box Cameras World 2015 which was published in August by D.I.S. Consulting of Woodstock, New York. The study looked at studio and box (POV/PTZ) camera use among seven vertical segments, worldwide. Those were broadcast/cable, production/post, mobile/OB, event video, independents, institutional sites and rental houses. In all, 1,583 professional end-users answered the online survey.

One factor that has helped reinvigorate camera sales and drive 4K adoption has been the advent a year ago of a series of studio models which can utilise 35mm sensors for Ultra High Definition yet accommodate 2/3-inch lenses, allowing legacy lenses to be mounted. That has saved stations, networks and mobile truck operators to repurpose very expensive long lenses and motorised zoom box lenses on new cameras that deliver 4K or 8K.

For users this has been seen as a breakthrough in their desire to upgrade to 4K and later 8K and prevented them from having to dump expensive 2/3-inch lenses for new 35mm ones. Leading this charge has been Hitachi but they were soon followed by Sony and Ikegami. Now others are planning to follow suit. Hitachi was rewarded for its innovation, last year, when 50 units of its model SK-UHD4000 were purchased by Gearhouse in the UK.

Cinematography cameras which produce 4K or other UHD signals have also begun to find their way into heretofore broadcast and institutional settings where their often inexpensive competitors – when compared with traditional studio models – are finding buyers.

Prices have also been a surprising factor this year, and the report showed prices in steep decreases to the apparent delight of end-users and chagrin of manufacturers. Part of this phenomenon has been driven by Blackmagic Design who introduced what they call their Studio Camera for only $1,995USD for HD and $2,995 for 4K. The days of the $100,000 plus studio camera are numbered.

Using a micro four thirds sensor and deliverable with or adaptable to third party lenses, the Blackmagic model has set a new – low – bar for pricing in the category and driven competitors to go lower in their pricing as well, challenging their ability to earn profits in the category. The camera had a few early shortcomings, such as lacking a 720p setting, but that has since been provided.

Whether this camera will be widely adopted for true TV station use or on trucks remains to be seen, but its arrival has shaken things up considerably. And, its true application may be institutional where budgets are limited.

Proliferation of cameras and media

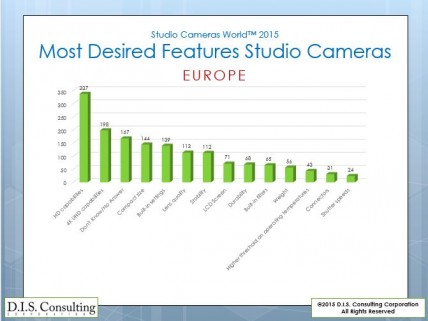

With technical changes in the industry occurring at such a rapid pace, the new studio camera study’s responses on desired features reveal interesting clues to what broadcasters and others are seeking in their next cameras. Among the most desired camera features considered for purchase in the next year are: HD capability, 4K/UHD, compact size, built-in settings and lens quality, respectively.

In Box/POV/PTZ cameras the main sales driver has been greater robotics use and intense demands in sporting applications, such as for overhead cameras and cameras in fixed, operator-less locations such as end zones and where multiple views are being increasingly offered as choices for viewers. Additionally, some models

are entering the market

offering UHD level resolution or higher, though those applications remain the exception to the rule.

If 4K is being adopted so quickly, can 8K be far behind? With the relative success being enjoyed by 4K (and in cine other versions of UHD), it seems inevitable that 8K adoption could follow suit. Some survey respondents were interested in 8K, but not many. And, the existence of actual owned/installed units remains rare. But, there are manufacturers like Sony, Ikegami and others testing the waters for the 8K level of resolution in studio models.

While the so-called studio camera is, by its imprimatur, found most commonly in a

TV station or on an OB truck, that no longer defines its use. Such cameras are increasingly found in churches, corporate studios, universities, sports use and even in wedding and events capture.

Where independents are producing episodic TV, they may more and more turn to multiple camera systems, utilising servo-zoom lenses and run things through a switcher than in the single-camera ‘film-style’ past. Even rental houses are now better able to rent them out, as they have become lighter, more compact, more likely to deliver 4K and more likely to accommodate a wider range of lenses than

ever before.

With the proliferation of flash media such as SD cards, solid state recorders and hard drives, recording has become almost as easy with a studio camera as it had been with a camcorder, making that traditional distinction – camcorders have self-contained recording versus studio cameras do not – somewhat outmoded.

As studio models have become smaller and lighter, the lenses are increasingly heavier and bulkier than the cameras, a reverse of the old days.

Today, users are more likely to have a camera hanging off their lens than a lens off their camera.