It debuted at the NAB Show just six years ago, shortly after the launch of Android TV Operator Tier and the acquisition of video processing provider Anvato. And while other IT giants have dipped a toe into the media technology industry only to beat a hasty retreat, Google has soared past long-established players to become the biggest vendor by far in our industry.

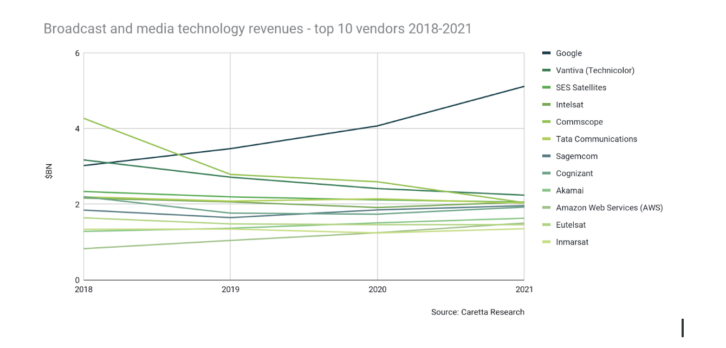

Caretta Research’s analysis shows Google’s revenues from media and broadcast topped $5 billion by the end of 2021, nearly 7 per cent of the entire value of the industry, and significantly more than the next two vendors combined.

This rise has happened exceptionally fast. Back in 2018, Google was comfortably among the top vendors, but not obviously dominant. But while the other large players have tended to cluster around the $2 billion revenue mark, Google has continued to accelerate.

How did Google grow so fast?

Detailed revenues for all the significant vendors in every media technology product segment are one of the key datasets we analyse, available in the Caretta Portal platform. This allows us to scrutinise the dynamics of each segment of the market.

Google’s now seemingly-unassailable position is driven by multiple factors: dominance of connected TV ad tech and pay TV middleware with Android TV Operator Tier, a strong play in analytics, and a growing slice of cloud services for the industry.

In contrast, several of the big legacy vendors are positioned in parts of the market that have been seeing significant pressure — such as satellite distribution, set-top boxes and conditional access.

It is pay-TV that has proven to be Google’s somewhat unexpected big success. Android TV Operator Tier is replacing the vast majority of set-top box middleware spend in the market as operators switch to the platform as they launch new super-aggregation plays.

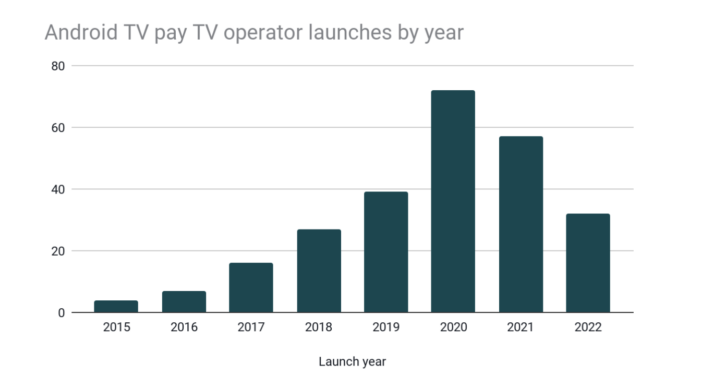

Google first entered the broadcast and media technology industry with Android TV in 2015 and rapidly expanded to over 250 operators by 2022, with peak new launches in 2020.

Have we reached ‘peak Android’?

The more recent drop-off in new Android TV deployments might suggest Google’s media tech revenues may flatten or decline. However, we are forecasting further growth for the company, based on the dynamics of the segments in which Google plays.

Set-top box middleware tends to be a compounding, long-term market. With Google gaining a foothold in hundreds of operators, longer-term growth will almost certainly follow as those operators continue to switch out legacy set-top boxes and grow their user base.

Google’s second growth engine is in analytics and CTV ad tech, a market that has surged. The company’s revenue here has more than doubled since 2018. As more content owners, operators and broadcasters try to broaden their revenue base, reduce dependence on subscriptions, and transition from linear TV advertising to digital, Google can only benefit.

Relying on Google for an increasing slice of advertising income might well mean dancing with the devil, but in the race to make streaming pay, it’s a very attractive devil with which to tango.

And Google’s third growth engine is public cloud storage and processing where GCP is becoming a very credible alternative to AWS and Azure, particularly for data-related tasks such as analytics and metadata enrichment — even if it lacks some of the content supply chain network effects that have propelled arch-rival AWS to media cloud dominance.

What’s the impact on the industry?

Google’s strategy has been largely good news for content owners and pay-TV operators, helping them compete more effectively in the streaming and digital market. The risks of working with a giant competitor have seemingly been more than offset by the upside benefits of having quicker access to better user experiences and more revenue.

For other large industry vendors, the news is less pretty. Google’s growing dominance is a competitive threat to an increasingly-wider set of companies. In those market segments where Google has focused, particularly in set-top box operating systems and CTV ad tech, it is on the way to achieving the kind of platform-level market share that we see in mobile OS and online ads where a dominant vendor takes around 60 per cent of revenue.

For small- and mid-size vendors, there is better news. Our analysis shows the share of revenue captured outside the top 10 companies growing from 67 per cent to 71 per cent between 2018 and 2021. In many cases, innovative new products are built on top of cloud services from providers like Google, creating accelerated opportunities for vendors to capture their own piece of the market and ride on Google’s coat tails.

At Caretta Research, we love analysing data because of the patterns it reveals and the stories it tells. These underpin business strategy — what products to launch, how to market them, how to best target which customers, understanding what competitors are doing. The rapid acceleration of Google to a position of market dominance within such a short space of time is just one of those stories.