A new report by the European Audiovisual Observatory has found the top 100 audiovisual companies in Europe grew by 17 per cent in 2021 when compared to 2016.

The report found that the growth was down to the “highly dynamic development” of SVoD revenues.

In comparison, the cumulated revenues of traditional broadcasters and pay-TV companies increased by 10 per cent compared to 2016.

Traditional players brought in 56 per cent of the incremental revenues delivered by the top 100 groups over the same period, said the report. However, the growth of the top 100 players was largely driven by the pure SVoD players, namely Netflix, Amazon, DAZN and Apple. Their cumulated revenues grew by a factor of 6 between 2016 and 2021 and accounted for 44 per cent of the growth of the top 100 players.

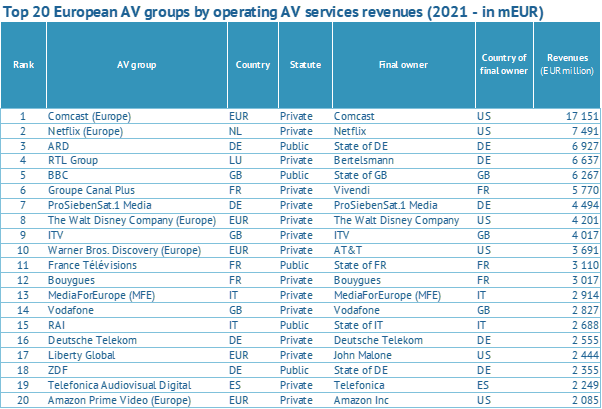

Despite that, the report names Comcast as the top European AV group by operating services revenues in 2021.

The top 20 players consistently represented 71 per cent of the top 100 revenue figures over the same period, added the report.

Public service broadcasters showed development under the average growth rate of the top 100 audiovisual companies, with a decrease of 3 per cent in 2021 compared to 2016, and consequently their market share dropped to 30 per cent in 2021.

The report also found that at the end of 2021:

- The top 100 audiovisual companies in Europe by operating AV service revenues were highly resilient, dynamic and drove the overall AV market growth

- M&A activity surged recently driven by telco players and this activity was more concentrated in the Central and Eastern Europe (CEE) region

- US interests in the European AV industry continued their upward trend as they prioritized direct investments as opposed to the traditional indirect ones

- The top AV players in Europe are eclectic as regards their core business which drives the revenues, as well as their internationalisation strategy

- On the market for pay services, excluding the distribution of third-party services by telcos, broadcasters got the lion’s share of subscriptions within the entire European-owned pay service market.

The full report is available to read here.