For many next generation projects, the most challenging issue by far is establishing the total return on investment (ROI), and agreeing how to monitor and deliver it, writes Russell Grute, in the first of a two-part series.

In our experience, the crunch comes during the late stages of negotiation, when the procurement department or the CFO renews their interest. The situation is already a long way down the line. The customers’ operational and technical teams have been prioritising their business requirements, future plans and securing budget approval for the investment. Perhaps they have issued a business-led RFP, whilst competing suppliers, SIs and service providers have done their legwork too. Lucky shortlisted vendors may have also hosted a dreaded proof-of-concept. And then it comes, a simple enough question from the CFO: ‘so…what’s our ROI on this project?’

The answer should and can be highly favourable. After all, the RFP said the project should be business-led. When investing a million dollars, shouldn’t there be a higher return? Yes. Definitely.

But without identifying a robust, pragmatic and achievable target from the outset, that return is easily lost along the way. Perhaps during an aggressive final negotiation, where cost reduction replaces the original project vision or key parts of the supplier’s value-add, or later during the project delivery where the day to day challenges in technology-led and operational testing displace the original business targets.

What do we mean by ROI?

Our context is a leading broadcaster, pay-TV operator, cable, satellite, service provider or telco investing in new cloud, IP, UHD, MAM and media logistics processes to drive their onscreen business and revenue. Let’s focus at a higher level on the real potential gains to improve their return, and better secure the project for all parties.

Mind the gap

Who is working toward the best overall ROI, and how? Is there a gap? During 2015, our engagements moved beyond improved media workflow and better solutions architectures, and instead looked at more closely integrating media planning with media operations to significantly improve the ROI. Great media services and workflow can only do so much without being driven more directly top-down by the business requirements.

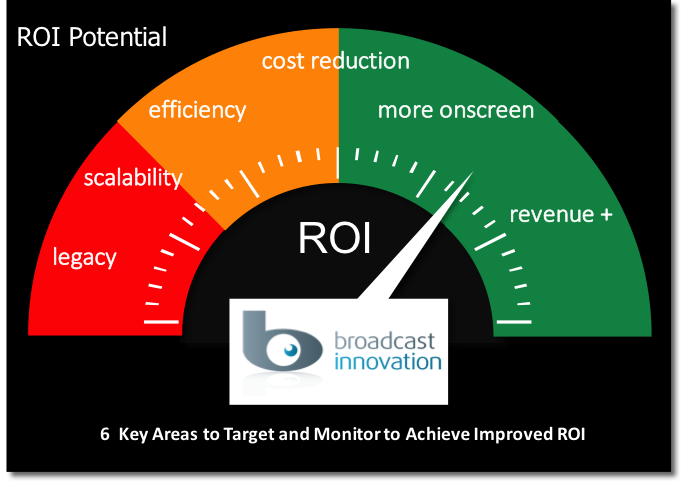

Using six core areas as shown, we devised a process to build from technology foundations, through operational efficiency, toward cost reduction and all the way up to onscreen planning and revenue. This process allowed us to work together from day one with stakeholders from media planning, production and operations, starting as early as possible to secure a positive ROI from the outset. Using this process whilst prioritising business-led requirements, workflow design and test planning provided a more informed pre-emptive estimate of optimal ROI.

Legacy

Global video insurgents like Amazon, Apple or YouTube, alongside new agile local competitors, use cloud-based SVoD and live OTT to pick and choose where to grab viewers’ digital and programmatic advertising pennies. Do these insurgents accelerate their ROI by leapfrogging today’s legacy? Have they even heard of a VTR, VDCP, MXF or LTO? They are sharply focused on their unique technology stacks, optimising their content rights, delivering the highest quality telco-friendly streaming, managing rich content metadata and crucially, subscriber intelligence. Netflix recently announced it was re-encoding its legacy content to improve picture quality and reduce streaming bandwidth.

Following an unsatisfactory RFP, caused by poor requirements prioritisation and low potential ROI, a broadcaster recently asked if we could help make up for lost time with even newer technology. In reality, the quickest and best strategy was not to look further forward, but instead to remove 12 months from the past. Systematically reducing legacy is now a significant contribution to positive ROI. Without a focused business-led view, and taking the painful yet necessary steps to discard legacy integration and inefficient manual processes in media workflow, the ROI from new technology alone is often too low.

More importantly, by 2016 some broadcasters are encumbered by their actual business organisations. Are the business and operations optimally configured for the new onscreen challenges ahead? Does the business really know its best options, and are those in-house or third party? Are media planning, production, media operations and technology in sync or out of alignment? Are those activities currently split between their legacy linear channels and growing digital services? How can branding and promos be adapted from multi-channel to multi-outlet? These are just some of the key business challenges that require attention alongside new technology investment.

Scalability and unit cost reduction

More content for wider audiences means higher throughput. Growing media businesses need predictable and cost effective scalability. For new entrants, their prospective growth may exceed their practical or financial capacity to invest pre-emptively in their own infrastructure, whilst established players may not be able to cope with peaks in demand, or be able to launch next generation services from their existing facilities.

A useful KPI to improve scalability is unit cost. We can’t predict what a new audience might pay – that’s beyond our equation here. But to calculate ROI, we can better estimate the unit costs of producing, packaging and/or distributing content, or at least find a unit. Using benchmarks such as media title throughput time, efficiency per role or business process versus number of versions, channels, streams or distribution outlets, that unit cost must go down. If it doesn’t, proposed new workflows are not yet optimised – try again.

“To succeed, you are either born in the cloud or legacy” I was told at the recent London AWS Media and Entertainment Cloud Symposium. Phew, that’s quite a statement, highlighting the crucial importance of aggressively discarding legacy coupled with a revolution in the cost base of media logistics and distribution. Does using AWS give a new type of benchmark in unit cost? In conjunction with value added software and services (especially security), web services are rapidly adjusting the potential ROI. (Other cloud-based storage and application services for broadcast and media are available, folks).

Elsewhere, the current industry-wide thrust to use IP to control, manage and stream live and on-demand video and audio for contribution, production and distribution is also clearly aimed at lower-cost scalability.

Efficiency and utilisation

Working top-down to improve media workflow can dramatically improve efficiency and ROI. Removing unnecessary concatenated manual and replicated tasks and achieving the correct workflow orchestration are crucial areas.

Improved efficiency is also based on utilisation. Higher levels of utilisation improve the ROI from both staff and technology, and this highlights one of the fundamental differences between the broadcast and media IT perceptions. Broadcast’s instinctive feel for the value of live and speed, versus the digital community’s trust in parallel and on-demand activities, leads to two very different perceptions of utilisation and thus ROI. Both are right of course, depending on the logistics, programming and presentation. Multi-channel and multi-screen challenge this balance, especially if the audience is on the move.

Alongside interoperability and scalability, utilisation is actually the key benefit from the use of IP; whether it is automatic recognition of wireless camera contribution sources or the use of the inherent multicast advantages of IP in task management, flow control, routing and distribution. Fundamentally, if the interoperability is good enough and, as an industry, we master the skills to command it, the wider use of IP will dramatically increase utilisation, and improve the ROI from investment in IP.

Improved utilisation is the key driver toward virtualisation, cloud and SaaS to improve ROI. Build a big one for the peak load versus pay as you go. If the big one is rarely used or you go so often that you are always paying, then the ROI will be lower. Defend a business or build a business.

Achieving ROI is not easy

For some media organisations in 2016, technology and organisational legacy is dramatically hindering progress, as well as reducing their ROI from new technology. Crucially, legacy thinking may also be stifling their innovation onscreen.

Reducing unit cost improves ROI. Content creation, media throughput and logistics continue their inexorable growth, currently driven by VoD and OTT, so new solutions must increase scalability and improve efficiency to reduce unit cost.

In well-run projects, practices such as business process design, programme management and software integration are recognised disciplines, yet in few projects is there sufficient overall ROI monitoring and control to secure the potential upsides.

For the broadcaster, it has been challenging so far to establish practical media IP solutions with a positive ROI. This is more than a technology barrier. In today’s disrupted and opportunistic value chains, new and existing actors are disrupting, competing or partnering as never before. Given sufficient standard interoperability, the ROI from IP will increase.

If the return on investment from new services and technology is optimised and it is based on practical solutions and safe delivery, then that’s good for everyone: customers, services partners and suppliers. Strategic project investment can proceed securely to enable broadcasters to continue their innovation in profitable future digital media entertainment services.

Next month we’ll look further up the dial, examining the upsides for ROI from new onscreen media services driving revenue growth, and at practical benchmarks and KPIs to monitor and deliver the required return over the required duration.