Gene Hoffman, chairman and CEO of Vindicia, talks to TVBEurope about the predicted growth of VoD services, the power of Netflix, and the future of premium OTT in Europe.

What is the future of premium OTT?

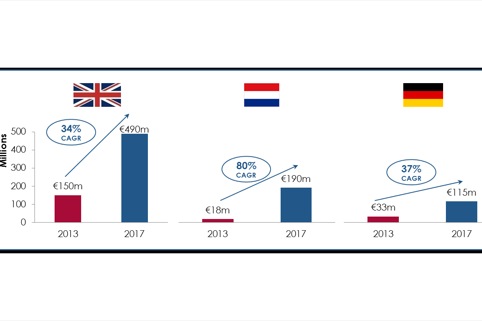

Subscription OTT video on demand (VoD) services are increasing in advanced Western European markets. This is largely due to key market enablers that are in place across the region, including high levels of broadband penetration, access to connected devices, a willingness and ability to pay for content online, and supportive regulatory environments. Furthermore, technology costs have fallen significantly, enabling a wide range of providers to enter the market. However, despite the market’s predicted growth – £110 million in 2013 rising to £390 million in 2017 in the UK alone – delivering services in a fragmented environment can be challenging.

For content providers, premium OTT is only one of various options for monetising video content. Indeed, other alternatives include transactional services, ad-supported content and bundled offerings such as TV Everywhere, provided as part of a membership package. The attractiveness of these business models varies widely for different categories of video content, from premium film and TV through to niche content, such as performing arts.

The power of Netflix

Netflix’s entry into the European market has encouraged interest in premium OTT as a business model. Indeed, it is now present in 16 per cent of UK households and has attracted a new wave of investment and service launches by other international OTT providers, pay TV operators and broadcasters. Industry participants are subsequently spending growing amounts of money on marketing and promotion, driving consumer awareness and understanding. It’s inevitable that premium OTT services will experience rapid growth across the region.

However, despite this, there is an element of caution amongst industry leaders about the growth prospects for premium OTT providers targeting the mass market. The market’s barriers to entry remain high, with content licensing costs increasing quickly and subscriber acquisitions needing significant investment. As a result, scale is crucial and incumbency is powerful, meaning only larger established enterprises, such as Netflix and Amazon, are able to support sustained investment. With this is mind, experts are predicting that only a handful of major mass-market premium OTT services will gain significant scale in each market.

Niche OTT opportunities

By contrast, opportunities for specialist or niche premium offerings are becoming far more accessible, especially to providers with low-cost access to high-quality, unique or exclusive video content and a clearly defined, addressable customer base. It is believed by fellow OTT providers that specialist premium service providers, with the right mix of content, technology and marketing, should be able to attract a reasonable number of subscribers, especially if services can grow internationally. Their success will be based upon well thought out subscription offerings that target well-defined fan bases or are bundled with existing membership or loyalty programmes.

Going forward, the prospects for premium OTT in key European markets will depend upon the particular characteristics of each local market, including the size and wealth of the territory, and its ability to support strong domestic TV businesses capable of developing and delivering competitive OTT offerings. Indeed, European consumers have demonstrated an appetite for premium TV and film offerings, delivered on-demand to the device of their choice, and, in many markets, European businesses are poised and well-positioned to respond.