Technicolor has unveiled its 2020-22 Strategic Plan, with three transactions aimed at strengthening its capital structure and strategic flexibility.

Following its financial downgrading last year, the company announced:

- Capital increase with preferential subscription rights for shareholders for a total gross amount of c. €300 million, issue premium included

- Extension of credit lines (RCF and bi-lateral ABL with Wells Fargo), originally maturing in 2021, to 2023 subject to the successful completion of the Rights Issue; the RCF will be reduced from €250m to €225m starting from 1st January 2021 and to €202.5m starting from 22nd December 2021

- New $110m short-term facility providing additional liquidity headroom

CEO Richard Moat, the renewed Board of Directors and management team designed the plan to streamline operations for the benefit of shareholders, employees, clients, suppliers and lenders.

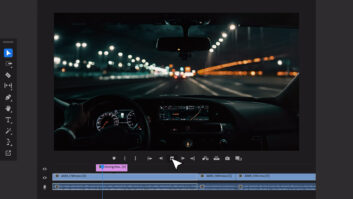

Technicolor said in a statement: “In Production Services, Technicolor is well placed to benefit from the burgeoning growth of streaming platforms and the unprecedented demand for original content and is well positioned to capture outsized market share in Film and Episodic, Advertising, and Animation.

“DVD Services has already started creating a more resilient business model through its ongoing cost optimisation efforts and the renewal of key major customer contracts under volume-based pricing schemes. Finally, in Connected Home, Technicolor will focus on Broadband gateway activities, which are experiencing an improved trading environment.”

The company also estimated its 2019 Financial Statements, which are currently being audited:

- Sales of c. €3.8bn reflecting double digit growth in Production Services, more than offset by a decline in the North American video segment in Connected Home and replication volume decline in DVD Services (as anticipated)

- Adjusted EBITDA of c. €246m reflecting solid improvement in Connected Home vs the first half 2019 as anticipated, driven mainly by margin recovery as a result of improvements in memory costs and benefits from our transformation plan

- Adjusted EBITA of c. €36m due to high rendering costs consumed in Production Services Film and Episodic Visual Effects in an intense period of deliveries and higher D&A linked to the investments in Film & Episodic Visual Effects

- Free cash flow of c. -€161m: as expected, and communicated in the 2019 third quarter press release, working capital at the end of the year was negatively affected by downgrades by the rating agencies in 2019. The impact is estimated to be -€95m, mainly explained by a one-off reduction in payment terms

- Net Debt of c. €961m (3.9x Net Debt / Adjusted EBITDA)

- Credit lines fully undrawn as of 31st December 2019