The entertainment industry will lose $160 billion of growth over the next five years because of the coronavirus pandemic.

According to figures from Ampere Analysis, the biggest impact will be felt in 2020 and throughout 2021, growth will be reduced each year for the duration of the five year forecast period.

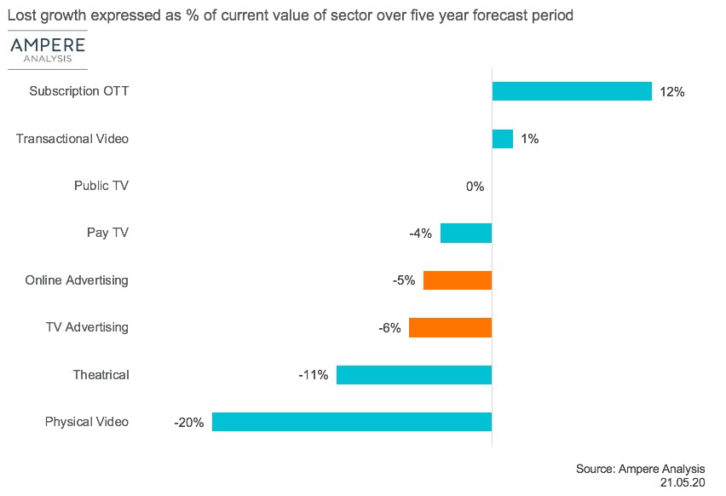

Over the five year forecast period, Ampere predicts the entertainment sector (excluding advertising) is set to lose a net $23 billion of growth compared to pre-Covid-19 forecasts. But it says proportionally, entertainment is the most robust of the two sectors, losing just 1.2 per cent of previously forecast value over the five year period. The sector is helped by a boost to the streaming market which will see additional growth and counter some of the loss.

Pay-TV, which has suffered from the loss of sports, will also lose significant value in what was already a challenging market structurally, representing around 4 per cent of its previously forecast value.

Ampere added that the crisis has accelerated trends that were already underway before the pandemic hit. The implementation of lockdown across the world has led to a huge surge in streaming consumption and new subscriptions, benefiting subscription video-on demand, broadcaster video on-demand and other catch-up services. The analysts said that while they expect to see some of these short-term gains reversed when lockdown is lifted, the shift toward on-demand viewing was already underway, so this acceleration caused by the current pandemic is a trend Ampere fully expects to remain after the crisis.

Guy Bisson, research director at Ampere Analysis said: “Streaming services are likely to come out on top here as viewers are leaning on streaming content providers heavily, just as a slew of new platforms enter the market. Yes, there will likely be a temporary post-lockdown backlash. But key to the longer term prospects is the acceleration of consumer behavioural change which will benefit streamers”.