According to PwC’s latest Global Entertainment and Media Outlook 2015-2019, the UK entertainment and media (E&M) market is expected to grow by 3.2 per cent compound annually (CAGR) from 2014-2019 to a value of £66.6 billion in 2019. In 2014, the UK had the second largest E&M market across Europe, the Middle East and Africa at £56.9 billion, behind Germany, and will maintain this position until 2019.

“Revenues from digital look set to reach a 50/50 share with non-digital in 2020, with the biggest revenue generators in digital being internet access and internet advertising, and the fastest growing digital sectors being TV advertising, out-of-home advertising and book publishing,” commented Phil Stokes, UK entertainment and media leader at PwC.

“Increasingly, though, it’s clear that consumers see no significant divide between digital and traditional media – what they want is more flexibility, freedom and convenience in when, where and how they interact with their preferred content.

More than a third of the expected market growth will internet specific, the report concluded, with consumers spending £13.2 billion on internet access and advertiser spending £11.6 billion on internet advertising. Mobile internet access is set to overtake fixed broadband in 2017, the report found, increasing by an annual growth rate of 7.1 per cent to reach £7 billion by 2019, the highest in Western Europe. As Stokes commented: “The scale and speed of growth in internet advertising, particularly mobile advertising, continues to be hugely impressive and the UK sets the pace for adoption of innovation.”

Offline, or non-digital activity generated 60 per cent of the market’s revenues last year, though all the market’s growth will be driven by digital, to the extent that it’s likely that will shift to be 50/50 in 2020. Some subsectors are moving even faster than that; with digital out-of home advertising overtaking physical forms in 2018, and consumer e-books surpassing print and audio books in the same year, the report predicted.

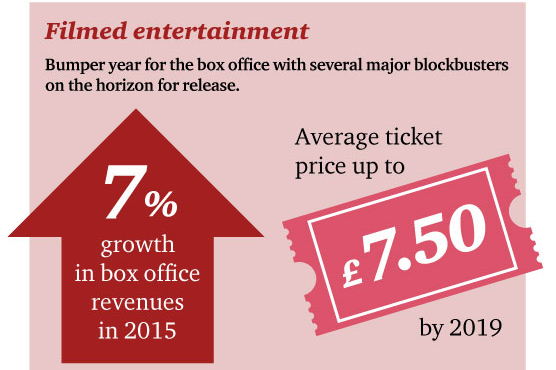

The increase in mobile internet and the increase of personalised, at-home, on-demand content has impacted more traditional methods of consumption. The UK box office revenue fell in 2014, slipping to £1.16 billion from £1.22 billion in 2013, due to a drop in attendances to 179 million, from 187 million in 2013. However, Stokes attributes this to “the lack of real blockbusters. The distraction of the football World Cup (the June/early July figures were especially weak) and a shortfall in younger cinemagoers.”

He predicts that the UK filmed entertainment will bounce back from a disappointing year with several major blockbusters in the pipeline in 2015 and beyond, including Avengers: Age ofUltron, Jurassic World, Spectre and Star Wars.