Neil Mayock has joined playout specialists Pebble as the company’s new chief commercial officer, with Alison Pavitt moving to the role of chief revenue officer.

Maycock joins Pebble from Grass Valley, where he was CMO and EVP of delivery and support.

In his new role at Pebble, he will be looking after marketing with a strategic focus in terms of the development of the business. “Part of the rationale behind chief commercial officer was that it’s a more appropriate vehicle for being able to talk to customers, and it does encompass the broader role,” he tells TVBEurope.

Maycock had previously worked with Pebble CEO Peter Mayhead at Pro-Bel in the mid-2000s, where they worked together on a management buyout. “What’s impressed me about Pebble is that it’s been run incredibly well in recent years,” he states. “It’s a financial performance I think a lot of companies in our sector would be very envious of. That was a huge tick for me.”

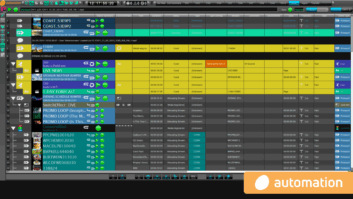

He is also excited by some of the company’s technology, both already in place and under development, including its IP control system, Pebble Control, and broadcast technology platform, Oceans. “The company’s now ideally positioned to look at new options going forward.,” says Maycock. “Our heritage is playout and we remain strong there and that’s a path forward, but I think now where we find ourselves at this point in time, there’s a whole lot of options and potential for the business.

“Part of my role is to come in and help work on that strategy of where Pebble can go,” Maycock continues. “With Alison as chief revenue officer and John Briggs, who has joined the company as chief operating officer, there’s a really strong leadership team and a very financially strong business.”

One of the things that particularly attracted Maycock to the company is how the company communicates its core values to both staff and customers. “They really live their values, it’s in everything they communicate,” he states. “Every employee has a little Pebble book with the company objectives and strategy for the year. So there’s incredible alignment with the values and strategy. I really like that because I’ve been at companies where we’ve had values and they don’t always relate to what’s happening in the business. Pebble are actually living their values, which is really nice, it reflects the culture of the business.”

Asked what he can bring to the company, Maycock jokes: “I’ve learnt a lot of what not to do in my career!”

He cites his time at SAM as the company amalgamated Quantel and Snell into one, as an example of a major success. “I feel it was a company that really punched above its weight, and that’s something we want to do with Pebble,” he adds.

“When SAM was acquired by Grass Valley, under the Belden ownership, we did a very extensive disciplined strategic planning process. It was a six-month-plus process. We bought a tonne of market research, we did really extensive modelling and all of this fed into Belden and set the agenda for Grass Valley. Now, there are a lot of companies where I would say 80 per cent of that is unnecessary, but 20 per cent of it is really valuable and so the sort of insight I can help Pebble with in terms of building strategies, is cherry-picking from that big corporate American process. We can pick the bits that are really going to add value for a company like Pebble where we’ve got some big strategic decisions to be made.”

It’s that experience of working for both small startups (Pro-Bel) and billion dollar corporations (Belden) that Maycock believes will stand him and the Pebble leadership team in good stead as they go forward. “Through all those years you learn what works and doesn’t work,” he says. “There’s some stuff that I look back on and I wish I hadn’t done it that way and I would do it differently going forward. I hope I can bring that experience to Pebble. It’s a very exciting, healthy business to do something with and the leadership team is really aligned into doing something big next. I’m looking forward to the day when we have to rebrand ourselves from Pebble to Rock!”

Maycock is brimming with ideas for his new role, in fact he says he’s finding it hard to sleep because he keeps waking up with new suggestions. In the short term, the focus will be on Pebble’s current technology, including Control and Oceans. “On top of that, we’re doing a real stand back and look at the industry, looking at what we’ve got from a technology perspective and where we can take it,” he adds. “A lot of that strategic planning process will take a few months.

“One of the things I’ve done in other businesses that works really well is developing the outline strategy and then talking to some senior customer contacts in the industry and using them as sounding boards. The feedback you get is tremendous, so that’s something we’ll be doing. The strategic stuff will start feeding into our 2024 business plan in terms of direction for the business.

Maycock adds: “There’s some nice exciting stuff in the short term that was happening at Pebble before I joined. So there’s plenty happening in the short term while we work on this broader strategy, and I think probably by IBC we’ll be giving a little more insight into where we think the business will be headed.”