Spending on products and services in the $48 billion broadcast and media technology industry shifted dramatically between 2012 and 2014, according to the newly released Global Market Valuation and Strategy Report (GMVR), published by IABM DC, a joint venture between IABM and Devoncroft Partners.

Now in its tenth year, the GMVR draws on actual and future projected revenue and product shipment data supplied to IABM DC by technology vendors and service providers. In aggregate, the 2015 GMVR data model covers approximately 3,000 technology vendors and service providers.

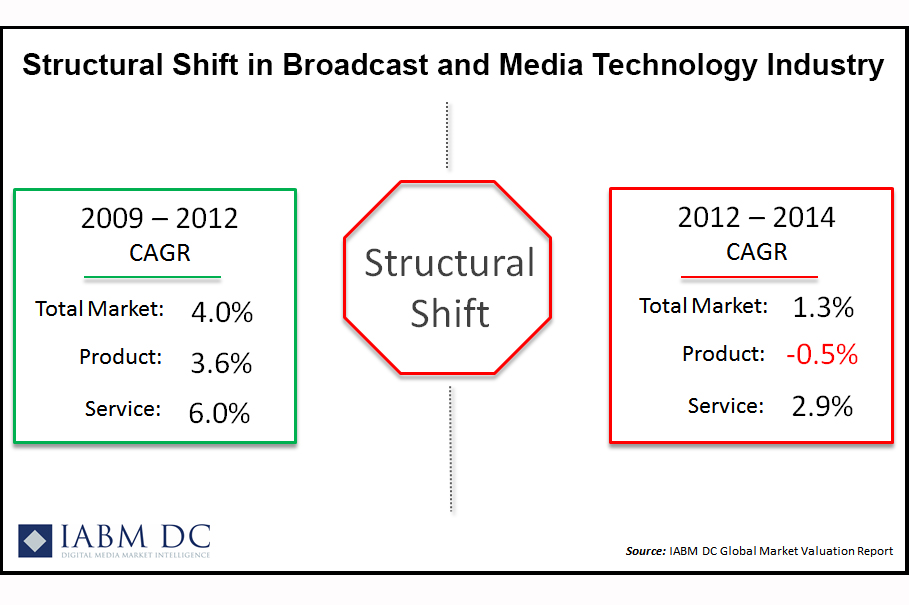

After experiencing a 4 per cent CAGR (compounded annual growth rate) between 2009 and 2012, the market total for broadcast and media technology products and services slowed considerably between 2012 and 2014, achieving a CAGR of 1.3 per cent.

Significantly, revenue from products (both hardware and software) declined by 0.5 per cent between 2012 and 2014, while revenue from services increased by 2.9 per cent. During 2014, services accounted for approximately $26 billion, or 54 per cent of total spending by broadcast and media technology end-users.

“The commercial models of many broadcasters and media companies have changed dramatically,” said Joe Zaller, founder and president of Devoncroft Partners. “The combination of new digital and online delivery platforms, the shift to a file-based workflows, the increasing need for digital monetisation, and the promise of commercial-off-the-shelf (COTS) IT hardware managed by software-defined networking have been catalysts for an industry-wide rethinking of both what technology is required to support future business goals, and whether it will be purchased or outsourced. We believe these factors will continue to alter the structure of the industry through the end of our forecast period (2018).”

Peter White, chief executive, IABM commented: “Although aggregate industry growth has changed, this is undoubtedly a dynamic time for our industry. Revenue in some product categories has shown a degree of decline, however other parts of the market are growing quickly. The changing media landscape affecting the demand side of the industry is having repercussions on the supply side as well, requiring a re-thinking of many business models. During this period of ‘metamorphosis’ there has been a slowdown of investment by end users as they seek a clearer vision of the business model and product roadmap going forward. Despite this hiatus confidence remains high in the broadcast and digital media technology market, particularly with the emergence of the many new innovations and opportunities that we anticipate will have a positive impact on growth.”