By the end of 2019, almost 85 per cent of UK households will have signed up to bundles of at least two telecom and media services from the same provider, according to a new forecast by global analyst house CCS Insight. Telecom and media companies will be forced to make new alliances and acquisitions in an effort to compete with market leaders Sky and Virgin Media, the company says.

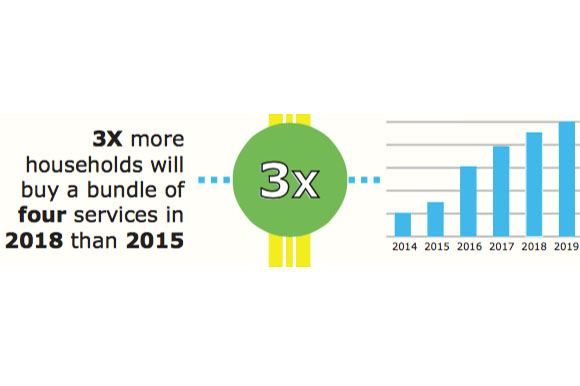

In 2015, more than 12 million UK households will commit to a bundle of three services from the same provider and a further 1.5 million will take a bundle of four services by the end of the year, with value, convenience and fewer bills the main reasons for signing up. CCS Insight expects the number of households purchasing bundles of four services to double in 2016, and to grow steadily in the near future, helped by consolidation of the telecom market, such as BT’s proposed acquisition of EE.

CCS Insight believes there will be substantial growth in the uptake of pay-TV services, driven by promotional activities, the roll out of new services, the emergence of new providers and a proliferation of no-contract options like Now TV.

“Over 40 per cent of UK households currently do not subscribe to pay-TV services: this is a huge opportunity,” said Paolo Pescatore, director of multiplay and media at CCS Insight. “BT has shown the way with the success of BT Sport. It’s now using its sport channels to drive up subscriptions to BT TV among its existing customers. It’s also targeting Sky TV customers who enjoy watching sports, while others like Virgin Media are positioning themselves as aggregators.”

“We will see similar battles in other types of programming beyond sport, fuelling further competition. We believe programmes, especially exclusive material, will be a key weapon in providers’ quest to secure customers. Those that offer a vast array of programmes will be better placed to succeed”, Pescatore continued.

Approaches like Lebara Play will provide further disruption and force established providers to continue innovating, and adoption of fibre broadband will help online video on-demand services like Netflix and Amazon Prime Instant. Pescatore commented: “These on-demand services pose a serious threat to telecom providers’ aspirations in video; the latter must react quickly and be able to move at web speed to counter this challenge”.