Is the previous trajectory charted by HD the most pertinent guide to an emergence of 3DTV as a mature product? Adrian Pennington reports.

The world’s first 3DTV channels launched 15 months ago in a blaze of publicity. Even now, new 3DTV commissions or 3D feature releases receive attention which belie the relatively limited nature of the content market.

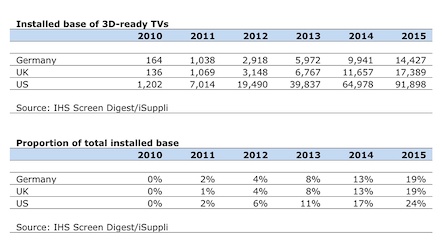

However, with the number of 3D-ready displays sold in the UK predicted to triple by the end of 2012 to 2.3m, predicts Futuresource Consulting — and with the number of worldwide 3D channels, demo channels or 3D VoD services expected to rise from 90 to around 110 in the next year — the market for 3DTV is only going one way.

The installed base and percentage of 3D-capable households will grow significantly over the next three to five years, says Futuresource market analyst Fiona Hoy, so that by 2015 close to half (47%) of US and UK households will own a 3DTV.

However, as she points out, many consumers purchase the 3D function by default — a key reason behind the dramatic growth.

There are also hindrances to market adoption, primarily poor consumer education of the format with many still struggling with the concept of Blu-ray; as well as negative publicity in relation to 3D causing viewer headaches and dizziness. “Consumers are also holding back investment in 3D, waiting for no-glasses technology to emerge,” notes Hoy.

For many, the trajectory charted by HD remains the most pertinent guide. It took more than a decade from introduction to become a mature product so we should not be impatient for 3DTV to reach those heights in only its second year.

“There are reassuring parallels between the stage we’re currently at with 3D and our work in popularising high definition TV in the UK,” says Sky 3D Channel Director, John Cassy (pictured left). “In 2006, Sky spearheaded the market for HD TV, and the fruits of that investment and innovation are being felt across the broadcasting landscape, to the extent that there are now well over 50 HD channels available on the Sky platform. I see no reason why we can’t similarly help drive the take-up of 3D in this country using a similar model.”

Cassy says subscribers to Sky 3D are in six figures “and growing comfortably” while recognising that the chief challenge is getting households with 3DTV sets to subscribe to Sky 3D.

The content gap, which at the beginning of 2011 was considered to be a major drawback to attracting customers to 3D services, has narrowed says Cassy. “At MIPCOM the increase in the number of good ideas went up significantly,” he says. “More and more 3D programming is coming through at increasingly high quality though some are sub-standard due to technical challenges.

“In the early days of HD there was a choice of about whether to buy an HDTV or not and today it is difficult to buy one that is not HD ready. The challenge for us is making sure that people are switching their 3D function on and enjoying 3D programming.”

While Sky is continuing with its mix of sports, movies and specials like 3 x 60’ Kew 3D and feature length The Bachelor King (both new from Atlantic Productions) it is also taking longer formats commissioned by Discovery Networks. CAN Communicate’s co-production with Renegade Pictures of the 10×60’ Safari Adventure for 3net is an example.

Across genre, costs can be double that of a 2D HD show, particularly if high volumes of CGI are involved, but the perception that 3D is high risk and high cost needs to be tackled, says Andrew Shelley, COO at OnSight (pictured).

“Producers are able to strip back the component parts of a 3D production in terms of processes, equipment and people to make an efficient and quality production,” he says. “There’s no silver bullet which will reduce the cost of making 3D. What is happening is that manufacturers are now talking to each other and developing innovative products that fill in the gaps in the workflow to reduce costs.”

Making 3D work

3D production is being driven by small and medium sized indies like OSF, Leopard Films, Renegade, Colonial Pictures and Atlantic Productions. Larger producers with repeat or volume commissions have yet to find a route into 3D, although it could be argued that Endemol-owned Tigress Productions 60’ natural history production Beautiful Freaks breaks that mould.

For Electric Sky MD David Pounds, producer of 10-part 3D extreme sports series High Octane, production is becoming more affordable.

“New Sony and Panasonic 3D camcorders are much more manageable than rigs — although rigs are still necessary for certain projects,” he says. “The latest version of Media Composer contains stereo tools which makes 3D more readily available in edit suites. Overall, 3D tools are much more accessible.”

He predicts that the 3DTV market will remain largely static over the next year, saying; “It is almost impossible to fund 3DTV without a 2D channel partner backing you in some shape or form.”

With Discovery boosting its European 3D commissions (though yet to launch a full 3D channel on the Sky platform) the UK market is dominated by original 3D programming from Sky. The BBC aired the live final of Strictly Come Dancing in 3D but it is occasional events like this and BBC Earth feature productions Walking with Dinosaurs 3D and The Enchanted Kingdom — as well as sports (an expanded 3D coverage at Wimbledon 2012 is planned) — which dominates the broadcaster’s strategy.

BBC Worldwide’s director of content strategy Jo Sermon says she is “exploring our top franchises,” which may mean Doctor Who, Antiques Roadshow or Top Gear. “Our strategy is to look at three or six part shows and make a one hour 3D special from them. This seems an interesting way of getting the 3D element off the ground and a business model that works.” An hour-long version of the 6×30’ CGI series Planet Dinosaur from Jellyfish Productions was the first to go this route.

Paul Berrow, CEO of distributor Log Media, advises that internationally branded one-off event programming is still the best option while distribution remains limited.

“If you are not approaching the 3D market in that way then you are going to be disappointed,” Berrow says. “It is incredibly unpredictable because you are starting from a blank canvas which is being filled in at random. The big players (Discovery, Sky) are moving at an entirely different pace from some European territories that have only just entered the fray. Everyone is trying to get empirical evidence about what works for what type of audience. Consequently the market changes every month with different feedback from broadcasters.”

Most stakeholders maintain that the 3D content will only fly with user-friendly displays that don’t require glasses. Tablets, smartphones and portable games consoles will be the first to bring autostereoscopic screens to mass market and could be a “game-changer”, suggests Anthony Geffen, creative director of Atlantic Productions and Sky joint-venture Colossus Productions.

“Our future 3D projects will start to link content into those new platforms,” he hints. “It will define our business model going forward.”

Sky’s Cassy feels that autostereoscopic screens will be a major point in the development of 3D. “There are already a number of different glasses-free tablets on the market and we are watching them closely. We have a partnership with Nintendo 3DS where short clips from Sky 3D are available to users on their consoles. Our aim is to showcase 3D and to encourage people to try it for real. We believe that if consumers really want to engage in 3D they need a proper size TV in the comfort of their living room as opposed to watching 3D on the go.”

“The market for 3DTV has split between large-scale projects shooting for example 4K for IMAX distribution, and lower budget approaches using cheaper technology,” says Geffen. “It’s the middle ground that’s really hard.”

He continues: “There is absolutely a place for producers on much lower budgets, cutting deals on technology and experimenting with cheaper technology. But people need to scale back a bit and put the emphasis on why 3D illuminates a story better than 2D.”

Provided editorial concept and technical execution are treated with care, there is no reason not to consider stereo 3D production a money-making option. This agenda will be pursued at TVBEurope’s upcoming 3D Masters 2012 conference at Bafta on 13 June — the essential forum for the European TV industry as it experiments with cheaper 3D production technology; new business opportunities; and the marriage of the right content with the appropriate stereoscopic storytelling techniques.