According to figures from Ampere Analysis, there is room for three billion additional streaming subscriptions across the world’s largest media markets, even though some territories are moving towards a ‘stacking ceiling’.

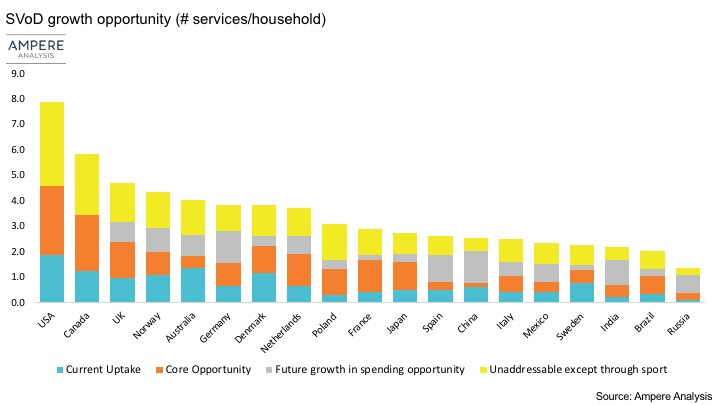

Ampere looked at 20 of the largest TV subscription markets worldwide to establish the theoretical ceiling for SVoD stacking behaviour. It suggests the highest maximum ceiling for SVoD services per household is in the United States, at roughly eight. In Europe, the ceiling is lower, at between two to five services per household.

The research states that various factors will limit how close individual markets will get to this ceiling and suggests one of those factors is sport. According to Ampere, pay-TV operators and networks currently control the majority of key sports rights in many major markets. Ampere’s past analysis has indicated that OTT players are unlikely to be able to wrest control of major domestic events in most developed markets. As a consequence, consumers who want to watch sport will have to continue subscribing to pay-TV services, which reduces the available budget for SVoD.

The real opportunity is between 2-4 sources per household, according to Ampere.

- After accounting for factors such as sport and future growth in spending, markets such as the UK and Germany have an average household capacity of roughly three services at current price points.

- But this apparently low capacity still translates into a sizeable number of subscriptions —88 million capacity in the UK and a 124 million capacity in Germany.

- In total, for the markets assessed, a realistic capacity is as high as a further 3 billion contracts

“To make the most of this capacity, OTT players first need to demonstrate that they are a viable replacement for existing paid-for TV services,” said Daniel Gadher, research manager at Ampere Analysis. “This process is ongoing in the US and Canada, but elsewhere in the world, pay-TV has remained resilient. But as US studio content increasingly moves to the online world, the opportunity for new players to take a share of consumer entertainment spending, even in already busy markets, improves.”