New figures from Kantar reveal Great Britain’s current cost of living crises has led to a fall in the number of households subscribing to at least one streaming service.

According to the company’s latest research, 16.9 million or 58 per cent of GB households now have at least one paid subscription, down by 215,000, quarter-on-quarter.

Kantar’s Entertainment on Demand study in Great Britain also identified the following dynamics within the VoD market for the three months to March 2022:

- 1.51 milloion SVoD services were cancelled by households in Q1 2022, up from 1.04 million the previous quarter and 1.20 million a year ago. More than half a million cancellations were attributed to ‘money saving’

- Streaming service penetration rate for GenZ households fell slightly for the first time, down to 74.6 per cent compared to 75.4 per cent in Q1 2020 and a peak of 75.8 per cent in Q4 2021

- Just 3.0 per cent of households in Great Britain signed up to a new video streaming subscription in Q1 2022, compared to 4.2 per cent during the same period in 2021

- The proportion of consumers planning to cancel SVoD services and stating the primary reason as ‘wanting to save money’ has risen to its highest ever level at 38 per cent, up from 29 per cent in Q4 2021.

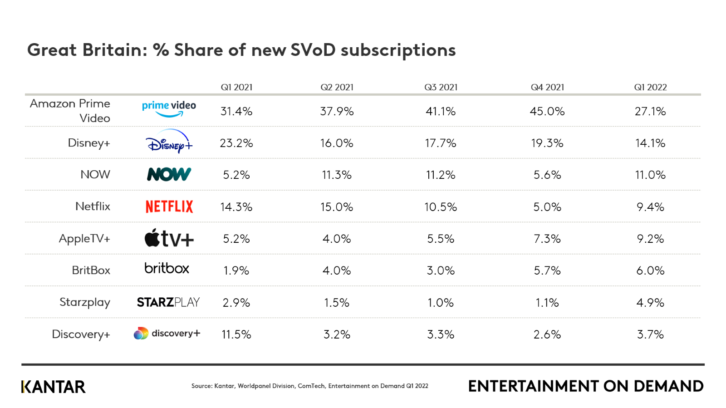

According to Kantar, Amazon Prime Video remains the most popular streaming service, attracting a 27.1 per cent share of Great Britain’s streaming market in Q1 2022. However, that number is significantly down on the previous quarter, when Amazon captured a 45.0 per cent share.

Speaking about the research, Dominic Sunnebo, global insight director, Kantar, Worldpanel Division, said: “With many streaming services having witnessed significant revenue growth during the height of Covid, this moment will be sobering. The evidence from these findings suggests that British households are now proactively looking for ways to save, and the SVoD market is already seeing the effects of this.

“As a result, it’s now more critical than ever that SVoD providers demonstrate to consumers how their services are indispensable in the home in what has become a heavily competitive market. New marketing and content acquisition strategies will likely need to be deployed to support this and avoid further churn.”