Research from Ampere Analysis suggests one in seven OTT households worldwide are “borrowing” account log in details.

The analysts define an account borrower as anyone who says they are using a login for a SVoD platform from someone outside of their household to access a service.

Ampere’s research also found:

- In the past 12 months, the proportion of global Internet users borrowing an account has increased, rising from 8 per cent in Q1 2019 to 11 per cent in Q1 2020.

- Ampere estimates that there are 70 million households borrowing one or more OTT accounts across 22 markets worldwide.

- This represents roughly one out of every seven households which have access to a subscription OTT service.

- The trend is highest in India, followed by the Netherlands and France, and lowest in Japan.

- Account borrowing is growing fastest in the UK, China and Indonesia.

- Account borrowers are more likely than average to be younger and students. However, over 50 per cent have full-time jobs and household incomes on-par with the average consumer. This means that a large proportion of the group does have purchasing power.

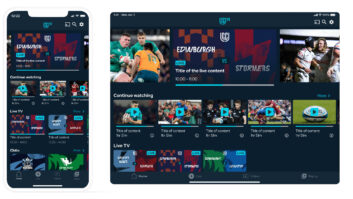

- Sports programming is particularly attractive to a subset of account borrowers. In Europe, a greater proportion of users of sports services such as NBA League Pass and NFL Game Pass are account borrowers. This is partly due to the seasonality of sport. Account borrowing by these users is likely to only be for a specific period, or by casual fans who don’t feel they watch enough to merit paying for a subscription.

Ampere adds that most consumers using another household’s login say they would pay extra for a service that gives them the content they want, presenting an opportunity for subscription OTT players to convert borrowers to buyers.

“Already pay-TV operators and aggregators are providing bundles with built-in discounts. Following Now TV’s example in the UK, services might offer cheaper one-off passes to allow casual viewers to dip in and out of their services without incurring high fees or being tied into an annual contract,” said Ampere.