By Richard Asquith (Global CEO, Kantar Media Audiences)

Watching fellow train passengers tuned into their own personal TV sets, whether on a smartphone or tablet, downloaded or streamed, no-one can deny that the way people watch TV is undergoing a revolution. Separating fact from perception: although the world is undoubtedly changing, research (from Thinkbox) shows that most television programming is still viewed live and on traditional TV sets. Old habits die hard, it seems.

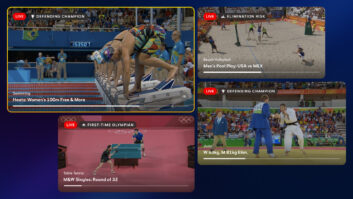

Beware business as usual: but, in an era where almost every consumer carries around a computer, and therefore a TV screen, in their pocket, it would be short-sighted of the TV industry to carry on as though nothing has changed. Steve Jobs’ vision in launching the iPhone and iPad has created a generation free to watch video content wherever and whenever it wants. While still relatively small-scale in terms of numbers, this is highly significant, as it’s driving such a fundamental change in the way people behave.

It’s also creating huge challenges for audience measurement, and companies like Kantar Media are developing new ways to measure who’s watching what, where and when. But will this put an unreasonable burden on the traditional audience measurement panels? And while viewing on new devices is still proportionally small, it can be hard to reconcile the additional costs of obtaining these figures.

A hybrid future: different, complementary ways of measuring viewing are emerging: panels provide detail about individual people, while large-scale census measurement from web players provides more granular data. The next step is to bring these together to create a hybrid model of measurement.

In a number of countries, this is exactly what is being planned by the bodies that oversee TV audience measurement. And it raises some new and interesting challenges for the TV measurement industry. Measurement companies will need to integrate multiple data sets without creating a perception of ‘black box’ analytics. The prospect of integrating proprietary information from broadcasters will also need to be tackled with clear, rigorously policed rules of governance.

Although this is challenging for both broadcasters and measurement companies, extracting data from the growing TV ecosystem offers significant rewards. Return Path Data is being linked to consumer data sets such as credit card data and car buying information to create more insights that will allow broadcasters to better monetise their activities. We’re also looking at qualitative social TV data, while continuing to deliver the trusted trading currency the media business relies on.

Content remains king: it’s important to acknowledge that, in the midst of all this change, the fundamentals of television viewing remain. People will always be drawn to the shared experience of watching TV together. And audiences will continue to demand great video content.

There is no denying that measuring how and where people get their television fix is increasingly challenging. However, our industry’s ongoing innovation and development of new systems is beginning to illuminate this altered TV landscape.