This year has seen a glut of camera brands and models proliferate and that has led to increased pressure on prices, a benefit to cinematographers and a challenge to manufacturers. The pressure which has been building for several years began to intensify at NAB with the advent of nearly a dozen new models, a number of them reaching down into some of the lowest prices we can remember for professional cameras.

This trend has resulted in an expansion of ownership in the low-end of the market and a related belt tightening at the top end. It has therefore engendered a ‘race to the bottom.’ You would wonder, who would want to win that race? Apparently, the answer is quite a few companies.

Primarily led by Blackmagic Design, whose camera prices have been breathtakingly low, others including JVC and AJA have been pushing 4K ‘cine’ capable cameras at sub-$5,000 price tags. One result of the drop in camera and camcorder prices has been the pressure on D-SLRs. Is this what has caused them to slow in the pro space recently, or could it be the rise of mirror-less models such as Sony’s increasingly popular A7 series?

This whole trend of lower and lower prices has pleased many professional end-users, particularly independents and film students putting field equipment together and now able to do so on the cheap. One question that begs an answer is just how long can a traditionally rental-oriented market absorb so many cameras and related gear?

At $995USD, and recently for a brief time discounted to $499USD, the BMD pocket-sized HD-only camera may be giving more grief to consumer-oriented GoPro than the full UHD camera companies. But, these low prices, while attractive to customers are stressful to companies used to making a reasonable profit from pricier cameras.

Making it in Hollywood

The third edition of Digital Cinematography World 2015, a global study looking at end-user feedback about what they are buying, using and planning, was published this spring by my firm, DIS Consulting. The study focused on four market segments: Production/Post, Mobile/OB, Independents and Rental Houses.

In all,1509 responses were tallied, worldwide. Although cameras and camcorders and D-SLRs are at the core of the study, it also covers complimentary products that include: solid state recorders, flash media, lighting, lenses, graphics and editing, switchers, cinema sound, displays, tripods and supports, servers and software and storage systems. As a screen, respondents to this study had to certify that they used the equipment they reported 51% of the time for movie-making or episodic TV programme production.

The 2015 study illustrated that despite the past demand for cameras that lifted this category, a near saturation level of segments may be approaching within the cine-centric spaces, while new 4K business drifts elsewhere, like into broadcast and institutional segments as well as event video. After all who wants an HD wedding video when you can have a 4K wedding video?

D-SLRs in particular seem lacklustre, even if they remain popular among film and TV students — a pre-professional segment we don’t regularly track. With 50,000 students graduating per year in the USA and more than 120,000 on a global scale, from the more than 1200 schools offering film programmes, they clearly remain a segment that can absorb more gear.

That’s bewildering considering the fact that so few, perhaps a few thousand, get absorbed into Hollywood and network ranks. The same core of a few thousands of cinematographers continue to lens most features that make wide distribution and no matter how big a year it might be at Sundance, that remains pretty consistent. The number of graduates that get absorbed into Hollywood ranks out of that hundred thousand students each year hovers at about two thousand.

A probably unintended consequence of catering to students and independents on a tight budget has been that less expensive camera models often side-step specifications and features that full-fledged filmmakers are demanding, such as faster frame rates, better chrominance and at times, some brands wholly ignore the most fundamental requirements.

Far be it from me to join the legions of disgruntled pros besmirching those brands who cut corners. We all know who they are. The phrase ‘you get what you pay for’ still resonates.

That said, the less expensive cameras are a boon to end-users on constricted budgets, whatever their projects, and as a result has represented a democratising movement in the industry. From the DCW-2015 technology trends section where interest in features was tested, those that were most desired in a next generation camera (camcorder or D-SLR) included as top desires: 8K, Autofocus, HDTV, 4K, High-Speed, respectively.

Saturated rental market

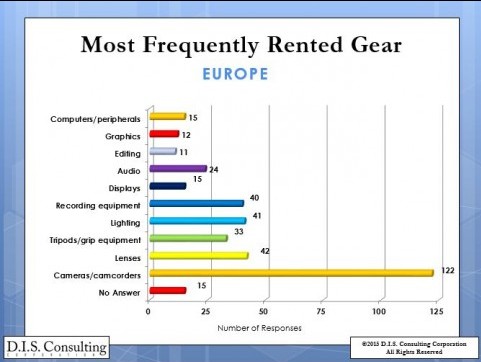

Rental habits die hard in this market. Our data shows that cinematography professionals still utilise rentals, consistently in cameras and even more especially for lenses, as they are very costly to own. The average respondent said that he or she rented 25 or more times per year and among those answers they generally indicated renting cameras, camcorders, lenses and lighting most. Also heavily rented were lighting and grip equipment.

To reinforce this fact, manufacturers have pounded the path to rental houses, virtually saturating them with cameras, lenses and accessories of use to cine gear renters.

The purchase of cine lenses has been aided, somewhat, by the growth of digital cinematography, but that has largely been among independents and at rental houses. When independents buy a camera they often get at least one lens. But, often that lens is part of a package.

Additional lenses can demand substantial out of pocket expenditures and that has often meant to rely on rentals as lenses are required for specific programmes being produced. Another trend in lenses has been a move away from solely using prime or fixed lenses and the rise of the use of zooms, which were formerly only seen in news or general video production and rarely, if ever, in motion picture production.