At NAB this year, TVBEurope conducted a survey with industry figures to gauge the state of the broadcast and media landscape, including a look at current trends as well as investment strategies and growth predictions for 2015.

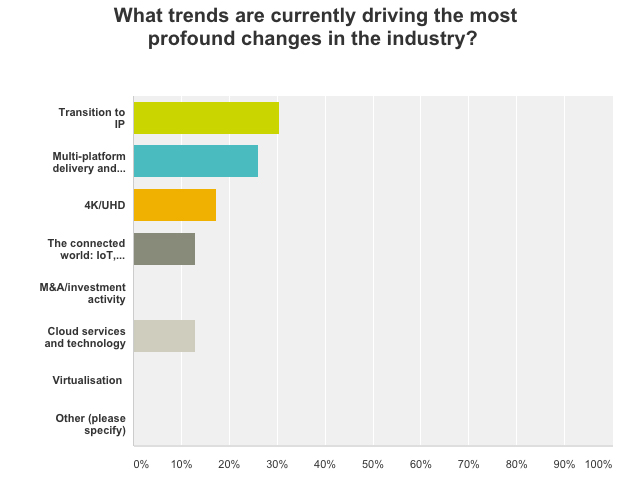

The transition to IP topped the poll as the trend driving the most profound changes in the industry at present, though interestingly this was not the area respondents were interested in learning more about. The industry is now more competitive than ever, driven by a mix of new and traditional companies in the space. Despite increased competition, companies are spending about the same on marketing compared to last year. When asked how optimistic they were feeling about business conditions in the market, the majority of respondents said they were reserving judgement.

A third of respondents agreed that the transition to IP is the trend most responsible for driving change in the broadcast industry. This was followed by multi-platform delivery and monetisation, and 4K/UHD. Despite the significant number of mergers and acquisitions in the industry over the past 18 months, none of the respondents saw M&A/investment activity as the trend most driving industry change. A fifth of respondents said they were interested in learning more about IP infrastructures: less than the 39 per cent who were more interested in learning about TV Everywhere, OTT delivery and monetisation.

The industry is more competitive than in previous years, the survey found, though this is not the result of new entrants to the market. When asked about the profile of competitors, almost three quarters agreed that there is a mix of new and traditional companies in the space.

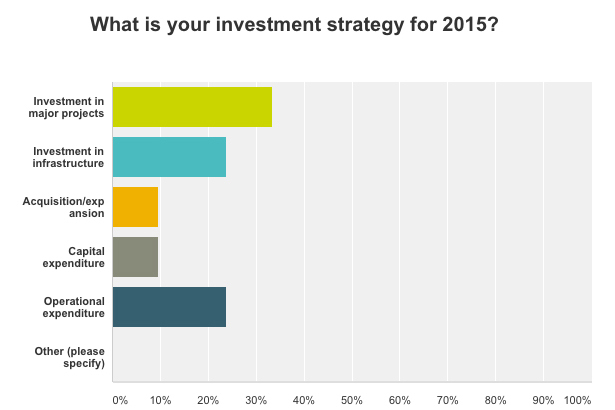

The past year has seen a large number of company buyouts and mergers, though when asked about investment strategy, acquisition and expansion was not top of the polls. Instead, the majority of respondents said they would be invested in major projects, followed by both infrastructure and operational expenditure.

Companies were vying for attention at NAB, with many stands seeming to be bigger and more eye-catching than ever. However, our survey found that while the greatest number of respondents are spending about the same on marketing compared with last year, none of the respondents are spending more on marketing, and surprisingly a fifth are actually spending less.

This year’s NAB reported attendance figures of 97,915, with 26,367 international attendees. Yet almost half of our survey respondents said that it is in Europe that they are seeing most activity for their business. The outlook of our respondents isn’t all positive though, as the majority of respondents expected only flat growth. A greater number of respondents said they were optimistic, rather than pessimistic, about business conditions in the market, yet over half said they would be reserving judgement.

The results and outlook for the rest of this year, then, seem to be mixed. The marketplace is more competitive than in previous years, and perhaps worryingly there was not a significant difference between the level of respondents who predicted ‘significant decline’ in business in 2015 (9 per cent) compared with those who predicted ‘significant growth’ (13 per cent). Despite this, almost half of those surveyed responded agreed it is in Europe that they are seeing the most business activity, so IBC2015 will still no doubt be a busy time for many.