The way sports fans consume media has changed dramatically over recent years. No longer are they reliant on watching live broadcasts on TV or having to avoid seeing the score until they can watch highlight shows in the evening. Instead, almost a third of sports fans are streaming live sports to their phone or tablet and 2018’s FIFA World Cup saw record numbers of fans streaming games. As broadcasters and sports federations adapt to this change in viewing habits, a growing number are developing their own over-the-top (OTT) services. For instance, sports fans can now subscribe to the NBA’s League Pass, Formula One’s F1 TV Pro or the NFL’s Game Pass to access live streams of events, as well as exclusive content such as interviews, whilst streaming service FloSports provides access to niche sports like bowls and cycling. Meanwhile, in a survey of sports industry executives, Imagen found that almost half (46 per cent) said their organisation is investing or planning to invest in the launch of a direct-to-consumer (DTC) streaming product in the future.

Over the course of the next year, when traditional broadcast deals come to an end, the DTC approach will become more popular. Launching a DTC platform is a fraction of the cost it once was and is easier than ever to set up. Arguably, niche sports have more to gain by addressing the consumer directly via OTT solutions, because their events won’t be subject to the priorities and schedules of the linear channels.

What can sports gain by going DTC?

A major benefit of sports associations developing OTT platforms is that they can promote a deeper engagement with their fans. While they already have deals with various broadcasters, a dedicated OTT service provides a more direct relationship with the audience. For sports organisations, a tailored, branded OTT platform provides an efficient way to engage with a geographically fragmented fan base, no matter where they live, unconstrained by TV schedules. It enables them to own and manage the entire user experience, helping to reinforce the brand while gathering valuable customer data. DTC channels are easier to market via social media, which is often an intrinsic part of the service and the sports also stand to increase revenues by being paid directly by the consumer.

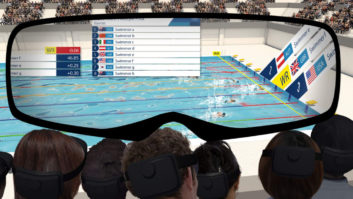

Additionally, DTC initiatives allow sports broadcasters and federations to play into the consumer trend of subscribing to OTT platforms such as Netflix. From a customer perspective, OTT services are supremely convenient and their popularity is evidenced by the number of new OTT services currently being launched, including Apple TV+. Fans can choose the content they want to watch, when they want to watch it, and on their preferred device. OTT can also deliver concurrent streams, offering a choice of viewpoints, as well as information and live data. Motorsport fans, for example, may have a number of screens open to view multiple camera angles, as well as lap times and race statistics.

Making DTC a success

While creating a DTC offering is fairly cheap and easy to set up, some niche sports platforms launching in 2020 will struggle to attract wide audiences, meaning this approach won’t be economically viable in the long-term. Therefore, some of these platforms may attempt to forge alliances with other services to offer ‘bundling’. This approach has been adopted by other streaming services including Disney+ in the US, which is offering customers a bundle alongside ESPN+ and Hulu, and means that for a set fee a user can gain access to all three platforms. If these partnerships mean that the fee is only slightly more than paying for just one platform, it could encourage more sports fans to sign up, helping to prop up DTC services that may struggle alone. Alternatively, smaller DTC offerings could be picked up by bigger sports organisations and integrated into their current offering.

DTC services are revolutionising sports media. In 2020, sports associations, federations, leagues and even individual teams that adopt a Cloud-based media management platform to create their own DTC offering will realise greater value from their content. While not all will succeed in reaching a big enough audience to make this economically viable, those that do will be able to use the platform to create their own narrative and provide a better, more direct service to an engaged, tech-savvy fan base. Though the DTC model might create some competitive tension within the world of sports broadcasting, it’s fair to say that, for the foreseeable future, more than one consumer model can exist at the same time in each market.