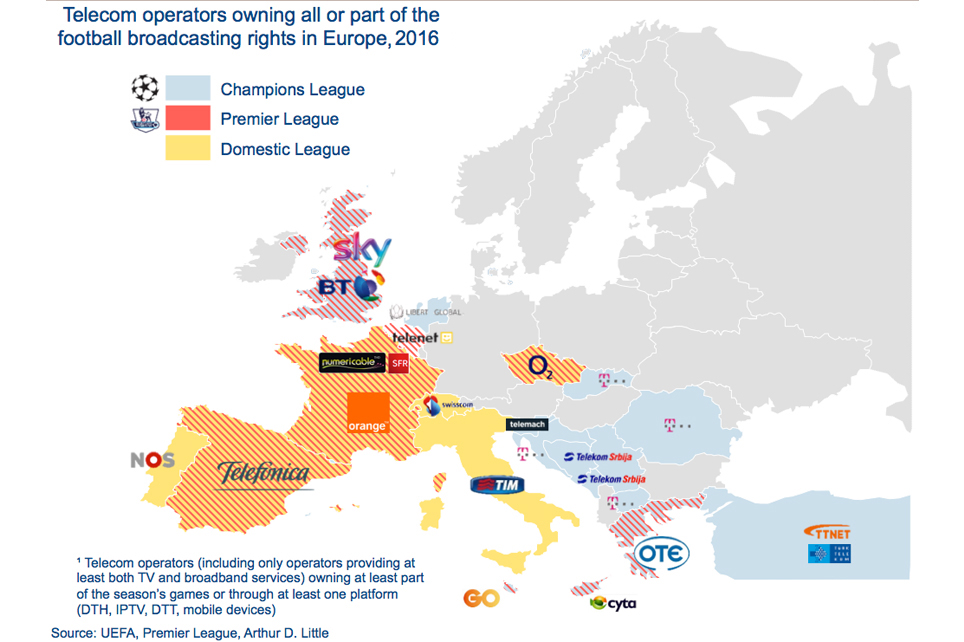

Traditional pay-TV operators across Europe compete fiercely for the exclusivity of premium sports broadcasting rights. In the context of maturing fixed-broadband markets, an increasing share of bundled offers and the rollout of super-fast broadband networks, telecom operators are also looking at these rights.

Content is gaining weight in the consumer buying decision for bundles, and operators cannot ignore this in their bid to maximise the share of connected households of broadband networks. However, the acquisition of sports broadcasting rights has become very expensive, resulting in squeezed margins and potential arbitrage versus network investments.

Triple-play bundles are becoming a commodity

In the age of fixed-broadband market saturation and fixed-mobile convergence, the increase of triple-play penetration is a proven means to reduce churn. In some Western European countries, triple-play bundles are sold as a commodity product (eg the UK, Spain and France). In these markets, consumers cannot choose a naked broadband connection from most providers anymore, and instead have to buy the triple-play product as a whole.

Consumers take three key decision criteria into consideration:

– Quality of the broadband connection

– Quality of the user interface

– Content proposition of the pay-TV offer

Sports-centric households are gaining share among pay-TV households

Historically, pay-TV operators have provided both exclusive movie content and live sports content. The former has been increasingly preyed upon by OTT players (e.g. Netflix). OTT players have been successful for three main reasons: offering an abundant catalogue (available anywhere at any time), at an affordable price and with a simple user interface. Therefore, the perceived value of the filmed entertainment content value proposition of pay-TV operators has come under pressure.

Thus, pay-TV operators are shifting their buying power to premium sports, and free-to-air (FTA) broadcasters are finding it increasingly difficult to retain such live sports rights.

The dilemma of FTTx rollout

FTTx broadband investments are very sensitive to the conversion of broadband households. Investment related to the acquisition of exclusive content has the potential to increase the share of connected households, thus leading to a reduced payback period for a large sunk investment. For an additional ten per cent investment and a resulting incremental five percentage point conversion of homes passed to homes connected, the payback period can be reduced by up to one year.

After many years of declining market share and increasing competition from alternative operators, all major European incumbents are (re-)engaging in long-term FTTx deployments again. Furthermore, a number of regulators have refrained from imposing wholesale regulation on fibre connections in order to encourage investments.

Telecom operators follow different strategies in positioning their broadband investments

In order to make a case for sports content investment, a number of parameters have to be taken into consideration. First, the respective market’s consumer appetite for premium sports content, and secondly the investment capacity of the individual players. Thirdly, the competitive intensity is a key driver for investment and differentiation. This competitive intensity is driven by the number of players, the presence of strong cable operators, regulation on the incumbent’s copper network, and government incentives for network investments.

Exclusive content can be used to:

– Provide additional differentiation in a competitive market

– Provide a positioning itself (rich content portfolio)

– Support the rollout of a super-fast broadband network

Acquisition strategies in premium sports content

The hegemonic strategy

The hegemonic strategy is built on having a monopoly on all major sports events. The content provider positions itself as the only place to offer an exhaustive sports content package. This suggests to consumers a two-sided pay-TV market – one player is premium whilst the others are commodity. Due to this unique selling proposition, the pay-TV provider can afford to charge a market premium.

Feasibility: Affordable only when the incumbent owner of rights.

The monopoly-breaker strategy

The monopoly-breaker strategy is mostly a reactive approach to a hegemonic player. This strategy typically leads to a bidding price war. In the UK, to usher in its fibre-optic rollout, BT has undertaken aggressive bidding for one of the most valuable Premier League packages, obtaining 18 first-choice games out of a possible 38. In 2013, BT won Champions League broadcasting rights starting in 2015, thus winning one of Sky’s most attractive assets.

Feasibility: Requires significant financial resources of the new entrants, as this strategy has long pay-back times. Some regulators even intervene and force sublicensing to reduce concentration of rights.

The game-changing strategy

The game-changing strategy is a response to the increasing costs of content rights when the value of exclusivity no longer supports positive business cases. Belgium’s incumbent and cable operators made a joint non-exclusive bid for Belgium’s football league using sports content as a differentiator against international OTT players. Furthermore, a number of challenger pay-TV players are considering strategies around secondary rights (eg highlights, OTT) with the aim to build a competitive proposition at a fraction of the cost of live linear rights.

Feasibility: A sound strategy that needs the commitment of multiple players or an eye for innovative packaging of secondary rights.

Excesses are eventually reined in by regulators

In 2010 in the UK, Ofcom forced Sky to wholesale its major sports channels, Sky Sport 1 and Sky Sport 2, to other pay-TV platforms such as IPTV and digital terrestrial TV. This led to all major TV platforms providing their subscribers with access to these channels. Recently in Spain, the regulator approved the acquisition of Canal+ by Telefonica under a specific condition obliging the telecom incumbent to wholesale 50 per cent of its premium content to pay-TV competitors at a price fixed by the regulator.

Live sports content will be a key battleground and ultimately drive consolidation

Direct-to-home (DTH) pay-TV operators that currently own significant parts of premium pay-TV rights will increasingly get under pressure from broadband operators. The latter are still cash rich, by now have a sizable number of pay-TV households (through IPTV and, in most cases, also DTH) and, with the current fixed broadband rollout, a large-scale business case to defend or improve.

Telecom and cable operators will employ the monopoly-breaker strategy, aiming for the Premier League and Champions League first. Once these are secured, national football leagues and other secondary sports rights will be added. However, only operators that can secure long-term funding of this strategy will be successful. Furthermore, similar to spectrum auctions, operators will need to carefully prepare for sports rights attributions.

However, bidding for premium sports rights provides only a relatively short-lived window of opportunity to differentiate, as auctions are typically repeated every three years. Furthermore, during this period of exclusivity, new entrants can acquire only part of the subscribers of the incumbent rights holders, as in many cases the pay-TV subscription is based on family consensus.

By Clemens Schwaiger, principal, global head of media, and Daniel Cheaib, TMT senior consultant at Arthur D. Little