Much has been said of millenials, but it is a new breed of consumer which media and entertainment (M&E) leaders need to analyse and understand: enter Generation Z. In its recent report, ‘From innovation to expectation – how M&E leaders are responding to Gen Z’, EY defines the group as digitally native, social media savvy, and the first to grow up immersed in mobile technology and mobile video. The entrepreneurial, innovative Generation Z play an active part in content discovery and creation, and seek immersive experiences.

Future consumers

The report defines Generation Z, sometimes called the iGeneration, as those born since the mid-1990s, representing about 25 per cent of the US population. Ninety-one per cent of teens (a core part of Generation Z) have access to a smartphone, 65 per cent have access to a tablet, 90 per cent watch YouTube daily, and in just four years time the group will make up as much as 40 per cent of the US consumer market.

In a rapidly progressing digital world, technologies such as virtual reality, driverless cars and 3D printing no longer surprise Generation Z, who have moved ‘from innovation to expectation’ and no longer see tech as disruptive.

M&E leaders must respond to changing consumption models, capturing consumer insights and translating them into viable products, services, business models and investments.

“Understanding the post-millennial consumer can prove challenging, but thanks to data analytics and sensor technologies, we now have more insight into customers than at any time in history,” said Martyn Whistler, EY media and entertainment lead analyst. “Media and entertainment companies struggling to understand their customers need to see this as a call to action, and to translate this information into viable products, services and business models. The industry as a whole is quickly shifting from B2B to B2C models, which makes understanding customers more paramount to success than ever before.”

To better understand where investments are being made, EY conducted proprietary analyses of two groups. These include today’s leading telecoms, technology and media companies but also the next generation of companies in those sectors. An analysis by EY of revenue streams, as well as investments and deal activity, reveals how the top ten in each of telecoms, technology and media remain leaders in core areas, but it also shows where overlaps are increasing. Convergence is happening in six principal areas, and by far the three most common are: digital advertising; electronic games; and cable, pay-TV networks and internet broadcasting (OTT).

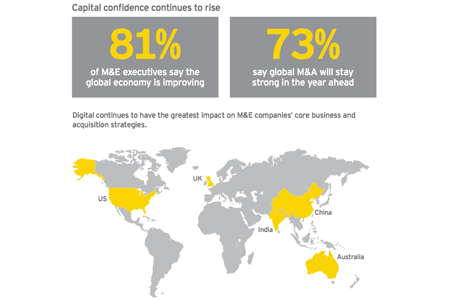

Unicorns exist

Analysis focuses on 60 ‘unicorns’; the world’s most value, privately held companies that are less than ten years old with market valuations greater than $1 billion. ‘Decacorns’ have a market valuation of $10 billion or greater. Incumbents are taking positions in unicorns and creating a web of investments: Vice Media has received two rounds of investment from Disney; NBCUniversal holds stakes in BuzzFeed and Vox Media; Comcast has a stake in Vox Media, is an investor in Jawbone, social network Nextdoor and fantasy sports provider FanDuel. Leaders are investing in unicorns to limit disruption, open up new distribution channels and capture new technology, and retain customers and access new ones. The outlook is positive, according to the report, with 81 per cent of M&E executives saying the global economy is improving, compared with 52 per cent who said that a year ago. In the year ahead, 73 per cent of executives indicate the M&A market will improve, up from 49 per cent last year.

Capitalising on IoT

The Internet of Things will play a significant role in obtaining and monetising on customer data, according to EY, allowing M&E companies to capture information about their customers and deliver relevant content accordingly. Success relies on combining three efforts: doubling down on data; telling stories and building experiences; and acquisitions. The set-top box can act as a data-collecting device, as demonstrated by Comcast, which collects viewing data from almost 90 per cent of its subscribers, and monetises this with personalised ad solutions, and by making data available to third parties.

Telling stories

The second focus for M&E companies needs to be on storytelling; Generation Z are interested in seamless experiences and building ongoing relationships, which M&E companies must capitalise on. Sky’s Sky Q box is an example of this, designed to create a TV viewing ‘ecosystem’ in the home, the service, launched in the UK in February, enables users to watch content all around the home on different devices, as part of what the company has dubbed ‘Fluid Viewing’. Sky Q allows users to control all connected devices, and offers, according to Sky’s Jeremy Darroch, “a brilliant new way for customers to experience TV on their terms”, and a solution which is “flexible and seamless”.

Seeking a partner

Partnerships and acquisitions are the fastest route to expanding capabilities, accessing new business models and achieving scale, according to the report. In order to reach new customers, technology, media and telecommunications companies are investing in common areas: voice/data connectivity and multichannel video distribution; cable pay-TV networks and internet broadcasting and digital advertising. In addition to telco and tech specialists, M&E leaders are seeking partners in cyber security services, health providers, automotive companies and appliance manufacturers. NBCUniversal’s Syfy Channel recently partnered with technology firm Philips, and is using its app to integrate programming with Philips’ Hue smart lighting system. Shows are synced to lighting with changes in the storyline reflected in changing colours and brightness. This offers a good example of what can be achieved by combining two elements of IoT, and offers a starting point for further development through novel collaborations.

It is vital for M&E leaders to acknowledge and better utilise data on Generation Z, an increasingly dominant proportion of consumers. It is only by gaining a better understanding of data on Generation Z’s behaviours and desires, EY reports, that M&E will win against emerging competitive threats.