The combined revenues of the 100 largest media and entertainment companies in the UK increased to a new record of £96.3 billion in the last financial year, according to a state of the sector report from Deloitte.

Revenue growth for the top 100 has grown 11 per cent from 2016 (£87 billion).

Media Metrics 2017 analyses the three-year financial performance of the top 100 revenue-generating media and entertainment companies in the UK. The report highlights the main trends and issues facing the sector, and how business models may need to evolve to reflect consumer demand.

TV production and distribution was once again the largest sub-sector in terms of revenue (£40 billion), average revenue per company (£2.1 billion) and also accounted for the largest share (41 per cent) of all revenues for companies in the index. Advertising was the second largest sub-sector in the index, generating £20 billion in combined revenues, followed by Information Publishing and Events (£18 billion).

The sub-sector was also the most profitable sub-sector, generating combined profits of £2.6 billion, up 57 per cent year-on-year. However, the top 100 as a whole saw profitability decline from last year, falling by 52 per cent to £4.8 billion (£9.9 billion in 2016).

The ten largest media and entertainment companies in the UK account for 70 per cent of revenues (£6 billion). By contrast, the bottom 50 companies account for just eight per cent of total revenues.

Dan Ison, lead partner for media and entertainment, said: “Against a backdrop of uncertainty, both politically and economically, over the last 12 months, it is reassuring to see that the UK media sector has performed robustly. The fact that this exciting and creative sector is close to £100 billion in size is nothing short of impressive.

“The UK is a global player in the media sector, which is partly why currency movements, and in particular a weakened pound, played a significant role in boosting year-on-year revenues by £10 billion. Managing foreign exchange risk will be an ever more important management skill in the coming years.

“The UK’s creative economy continues to be a valued export market, and punches above its weight when it comes to sating the global appetite for media content. The future success stories in the world of film, TV, video gaming and music will be dependent on the continued preservation of the UK’s creativity.”

According to the report, consumer appetite for live content is still strong, despite advances in technology and digital adoption. Two of the three largest media sub-sectors in the top 100 index – TV production and distribution, and information publishing and events – both generate much of their revenue and profit through the consumption of live content. Trade fairs, business conferences, live music gigs and theatre remain popular revenue generators, and catering for this demand will be core to the business strategies for many media companies.

Paul Lee, head of technology, media and telecommunications research at Deloitte, added: “Demand for live experiences has remained vibrant and valuable for both businesses and consumers. Whilst digital technology, such as streaming and video, has improved dramatically over the last few years, our research has found that people still like to attend live events.

“Being able to say “I was there” is still highly valued in a market where demand is often FOMO-driven. Networking, socialising and experiencing events are, for the time being, difficult to fully replicate in a digital format.”

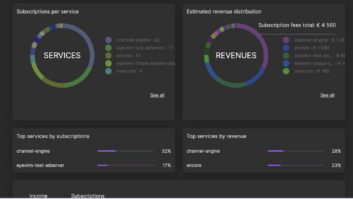

The report also asks whether publishers that rely solely on advertising models to fund online content can compete with the success and dominance of the digital giants that have emerged over the last decade. Consumers are faced with a proliferation of online content available to them, and this over-supply has had a significant impact on the revenue-earning potential of online advertising. As a result, online publishers are increasingly adopting subscription business models.

Ison continued: “The internet offers a route to a global marketplace of billions of readers, which is why the ad-funded online model has remained alluring. However, it is a model that has historically proven to be challenging to monetise, particularly for publishers who only see significant value being generated from a tiny proportion of this huge market.

“The advertising-only business model has an expiration date for some publishers. Over the past year we have seen an increasing number of news publishers earning regular income from subscribers. This is a trend that is likely to continue in order for these outlets to remain financially sustainable.

“In focusing on subscriptions, publishing would be following in the commercial footsteps taken by business information services, telecoms, pay-TV, music and an increasing range of consumer goods.”