“Media companies don’t need a digital strategy anymore; they need a business strategy fit for the digital age,” says Phil Stokes, entertainment and media lead partner at PwC.

In releasing its latest Global Entertainment and Media Outlook 2014-2018, PricewaterhouseCoopers (PwC) has detailed its vision for the near-term future of the UK media and entertainment industry, suggesting a change of strategy might be a prudent course of action for some entities in the sector.

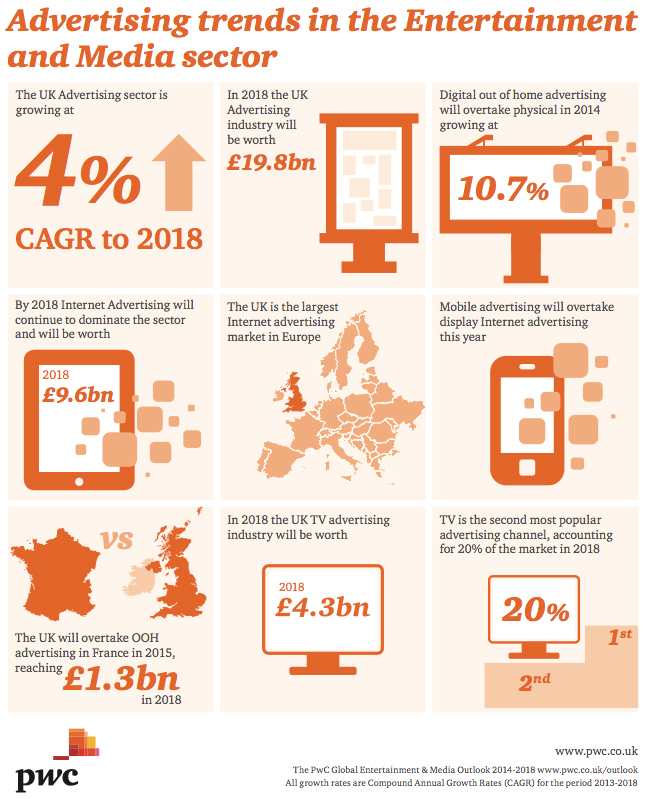

The outlook predicts the value of the UK media and entertainment sector to reach £64 billion by 2018, representative of a compound annual growth rate (CAGR) of 3.1 per cent from £58.6 billion in 2013. Internet access and TV advertising were among the fastest growing areas highlighted in the report.

TV advertising is forecast to grow to £4.3 billion in 2018, up from £3.7 billion in 2013 at CAGR of 3.5 per cent, with filmed entertainment increasing from £3.9 billion to £4.3 billion over the same period, with the UK accounting for seven per cent of global revenues.

“The entertainment and media industry is at the forefront of the digital revolution, because so many of its products and services can already be delivered in digital form,” explained Phil Stokes, entertainment and media lead partner at PwC.

“It may not be long before digital revenues from print, film, publishing and music overtake physical revenues in some markets. Media companies don’t need a digital strategy anymore; they need a business strategy, and a business model, which is fit for the digital age.”

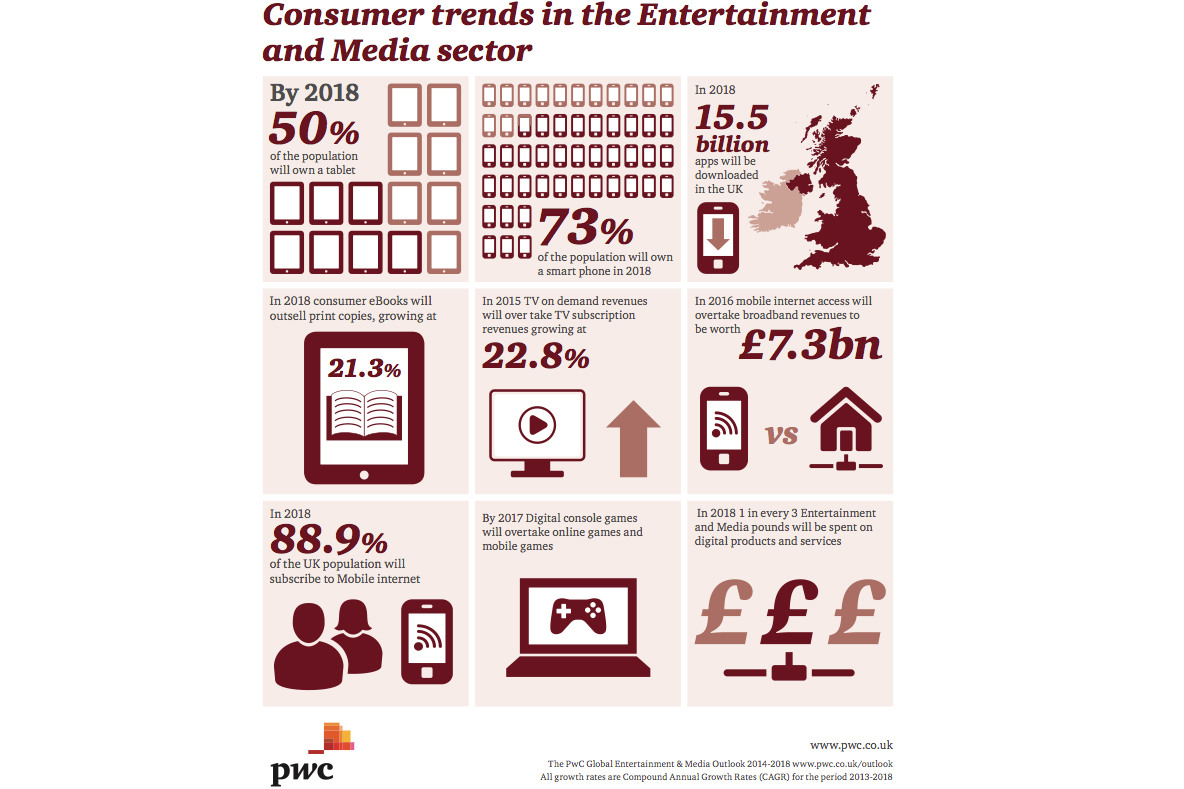

The findings from the report will make for keen reading across the broadcast sector, coming at a time where all stakeholders in the industry are managing the shift towards an increasingly digital marketplace. This is highlighted within the outlook, which forecasts that 50 per cent of people in the UK will own a tablet by 2018, with 73 per cent owning smartphones – devices that are the new consumption points for modern on-demand TV and media content.

Also highlighted is the (albeit limited) growth of the fixed broadband market, which puts the number of subscribers at 25.4 million (equivalent to 84.6 per cent of households) by 2018, representing CAGR of 2.3 per cent from 2013. Interestingly, revenue from mobile internet access is set to eclipse fixed broadband in 2016, with the mobile market growing at a much faster rate due to competition for 4G customers.

“This growth is being driven by the internet and by consumers’ love of new technology,” Stokes continued. “Particularly mobile technology and applications powered by analytics and the cloud; they demand excellence in customer experience – a social experience as well as a personal one.”

The discussion around the customer experience and personalised content was a standout theme from this week’s Beyond HD Masters conference, where speakers debated technological progress against the expectations of the viewer, and how personal preference could – and perhaps should – drive a new breed of personalised content that can be consumed across all available devices.

“Forget audience fragmentation. From a consumer’s angle, it’s about ubiquity – a consistent feel across multiple devices. Building this relationship offers a global opportunity as the economy moves from the delivery of products and services to the delivery of outcomes and experiences.”

That final point is perhaps the most pertinent: the delivery of outcomes and experiences. If the broadcast sector is to appropriately keep pace with the digital evolution, then perhaps language such as this should be more widely adopted, and embraced. TV broadcast has always had engagement at its heart, and despite the furore around the amount and quality of pixels on ever expanding screens, content remains ‘king’, as many Beyond HD Masters speakers compelled.

However, even that universally agreed-upon sentiment might not hit the mark for viewers of increasingly elaborate demands and expectations. Perhaps it’s not all about content, but rather the delivery of experiences; the encapsulation of several component parts that engages the viewer to their own specifications, on their own terms.

More information on the Global Entertainment and Media Outlook report can be found on the PwC website.