Covid-19 impact on media markets

The crisis caused by Covid-19 is having short-term impacts that TVBEurope has already been reporting (EBU Covid-19 Crisis Report). From the perspective of the European Broadcasting Union (EBU), the five most immediate impacts are as follows:

- The need to quickly change working conditions within broadcasters to adapt to new safety measures and ensure continuity of operations

- The damage to the advertising revenue of free-to-air broadcasters

- The halt of productions and the consequent shortage of supply of new material it generates

- The complete absence of live sports, generating additional shortage of a key TV content

- The closure of cinemas and how it is reshaping the release windows

As in every crisis, we also see some immediate winners, such as OTT streaming offers (not just SVoD players but OTT offers in general), online gaming and esports, all of them experiencing growing consumption and customer base.

After the initial impact, players in the industry are now reshaping their strategies in order to address the many medium-term challenges ahead:

- Uncertainty over the funding of many traditional media outlets due to the forthcoming economic recession and associated advertising crisis

- Concerns over public media funding in a context of economic recession

- As a result of the challenges above, the uncertainty on the production sector, which mainly relies on free-to-air broadcasters, the main investors and supporters of the European creative sector

- Changes in the balance between scripted and unscripted content in the audiovisual content sector

- Redefinition of business models and monetisation schemes in the sports sector

- Increasing importance of gaming and esports as components of the audiovisual value chain

- Increasing questioning over the windowing system governing the European film industry in a fragile balance between cinemas, pay-TV operators, free-to-air broadcasters, and OTT platforms

- Accelerated mutation to OTT streaming and on-demand media consumption

Covid-19 impact on digital media consumption

Media consumption has increased during the Covid-19 pandemic and its associated lockdown, with some immediate trends also becoming clear:

- Most internet users reported an increase in their time spent watching news, through all kinds of media

- Lockdowns boosted the increase in digital media use more than for traditional media

- As time goes by, people were craving less for news and turned to digital media for entertainment

- Linked to this, a corona-fatigue was starting to be detected in different surveys. People already had enough basic information and they were feeling depressed and anxious with the news so they started to avoid [news outlets]

- Video streaming was the top media activity to increase for youth, followed by online videos

- Most media habits are expected to go back to normal after the crisis. However, for youth, the most mentioned behaviour to be continued after the crisis is more video streaming time

- In-home habits changed more dramatically for parents with young kids, for example over-relying on mobile phones over other devices

Given the nature of the EBU, we also have a special interest in understanding how consumption changed particularly in relation to the digital offer of public broadcasters. In that sense, we saw unprecedented growth in interactions with public broadcasters’ news-related posts on Facebook and Twitter, doubling from February to March 2020.

Similarly, public service media (PSM) YouTube news channels peaked mid-March as citizens went online for news on Covid-19. Beyond news, another area in which public broadcasters saw a huge increase in consumption was on children’s content, boosted from March whether on YouTube or on their own dedicated websites as schools remained closed and children stayed at home.

- TV and radio most trusted news sources: EBU

- Trusted News Initiative to fight coronavirus misinformation

- Farewell to Eurovision after a decade at the top

Public service media audience performance during covid-19

This brings the discussion into a core element of public service media: their provision of news. In these times of severe crisis, we have witnessed how audiences have turned to public service media for reliable information across TV, radio and digital.

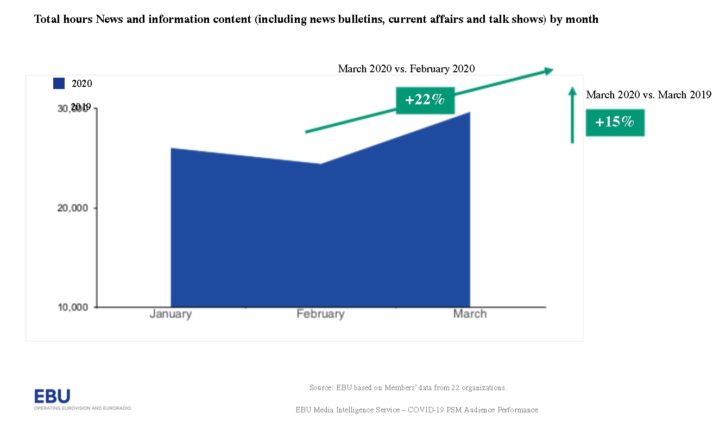

Responding to the sudden demand of news on a permanent basis, public broadcasters multiplied their news content across platforms (+22 per cent more news hours in March vs. February 2020) (Figure 1). This increased offer was paired with an increasing consumption. Reach of public service media’s evening news went up to x2.5 the average during peak days of Covid-19 crisis, those when key announcements were made: declared state of emergency, restriction of movements, etc.

Across Europe, the flagship evening news programmes of public broadcasters saw an average 20 per cent increase in daily viewing. The growth was more noticeable among younger demographics, with youth (15-24s) up a staggering 44 per cent and young adults (25-34s) an even more impactful +53 per cent. These are typically hard to reach target groups for broadcasters and especially for public broadcasters, but the crisis illustrated well that those groups also turned to trustworthy sources of information during a big crisis.

This increase was also unprecedented in the online properties of public broadcasters. Sessions on their news apps doubled in March 2020 as citizens were looking for regular updates on the pandemic. Daily reach more than doubled too.

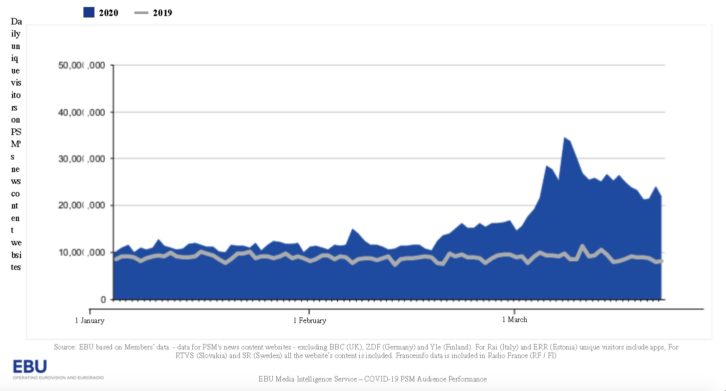

People visited PSM’s website to read, listen and watch news content amid the COVID-19 crisis. The number of unique visitors started to significantly increase in the end of February to reach a peak on March 15 with more than 34.5 million unique visitors for news content (Figure 2). In the second part of March the number of daily unique visitors decreased although since then it has remained well above traditional levels.

The post-covid reality

This crisis is seriously challenging some of the assumptions in the media industry. If the industry was already the most disrupted by digitisation, the crisis is likely to accelerate many of the trends already observed.

The transition to digital among audiences is probably going to speed up, as the crisis was the perfect excuse for some people to try new online services and some of those users are likely to stay. This preludes a perfect storm in that domain, with the so-called streaming wars already coming to Europe and broadcasters shifting more resources into their own online platforms.

In terms of production, digital transformation is no longer an aspiration for many broadcasters but the new reality: many have moved forward more in six weeks than in six years. And despite some adjustments, there seems to be no way back. We have heard some broadcasters questioning for the first time the primacy of technical quality over other elements such as agility.

What is to come is more uncertain than ever, as this crisis is unprecedented in modern times. This is probably one of the few certainties of all this situation.